Sector

Active Capital backs Lumat

GP acquires a significant majority stake in Dutch yarns distributor Lumat in MBO deal

Sunstone divests stake in Asetek for NOK 150m

VC firm intends to distribute the proceeds of NOK 150m to VУІkstfonden, the Danish growth fund

Naxicap enters exclusive negotiations to buy ECS

GP is in talks to buy French outsourced airfreight operations service ECS from Alpha

VC firms invest €25m in Geld-für-Flug

Hannover-based Seed + Speed Ventures took part in the round alongside Luxembourg-based EPI

Equistone's Averys bolts on Storax

Following the deal, Storax will continue to operate as an independent company with its own brand

Allegra Capital acquires Bring Citymail

After the deal, the company will continue trading under its established Citymail brand

Seventure holds first close on €24m

France-based animal nutrition specialist Adisseo is among Seventure's AVF fund investors

CapMan's Harvia lists with €93.5m market cap

Total value of the shares is expected to correspond to a market cap of around тЌ93.5m

Barber of Sheffield acquires The Tattoo Shop

Acquisition of The Tattoo Shop is Barber's third investment in the last four months

Verdane closes debut buyout fund on SEK 3bn hard-cap

With its new fund, Verdane intends to acquire direct control positions in large Nordic companies

BGF invests £8.5m in IFA

Funding will be used to bolster growth by enhancing manufacturing and testing capabilities

BGF divests Duncan & Todd as part of LDC-led SBO

Opticians group will pursue an acquisitive growth strategy under LDC's ownership

PAI, BCIMC finalise €1.58bn Refresco take-private

97.4% of the company's issued and outstanding shares are tendered at €20 per share

Anterra's food and agriculture tech fund reaches $200m

Anterra extends the fund to capitalise on the global food sector and expands its team

Triton sells stake in Befesa

Shares are valued at approximately €123.9m, based on the share price of €41.30 per share

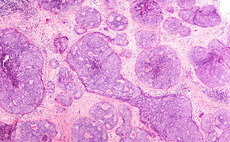

Principia leads €10m series-A for CheckMab

GP deploys capital from its healthcare-dedicated vehicle Principia III to finance the investment

Mentha Capital's Destiny bolts-on Motto Communications

GP injects new equity into Destiny to finance acquisition of Dutch cloud service Motto

Capnamic leads €4m series-A for Userlane

High-Tech Gründerfonds, Commerzbank's Main Incubator and FTR Ventures also take part

GIC in £100m round for Oxford Nanopore

Deal gives the UK-based gene-sequencing devices company an equity valuation of ТЃ1.5bn

GP Bullhound injects $3.1m into Quixel

Quixel will use the extra funding to accelerate the growth of its content library

Northzone, Creandum in $17m funding round for Kahoot

With the fresh capital, Kahoot plans to accelerate the development of its platform

VC-backed N26 raises $160m

Earlybird Venture Capital, Horizons Ventures and Valar Ventures previously backed the business

Idinvest, Brighteye Ventures back Ornikar

GPs take part in a €10m series-A round for the French online driving school

Maj Invest exits DK-Foods

Sale ends a two-year holding period for Maj Invest, which acquired the company in January 2016