Sector

Pamplona looking to buy Ruetgers from Triton

Pamplona Capital Management is in advanced talks to acquire German chemicals business Ruetgers from fellow private equity house Triton, according to reports.

123Venture et al back Global Hygiène MBI

123Venture, A Plus Finance and Calliode have invested in the management buy-in of French paper products manufacturer Global Hygiène.

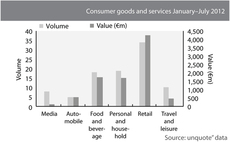

European retail outshines rest of consumer sector in 2012

Retail has seen private equity transactions totalling €4.3bn since January 2012, outpacing the rest of the consumer goods and services sector.

Better Capital offers to buy JJB debt

Better Capital, the turnaround firm headed by Jon Moulton, is reportedly looking to buy the debt of struggling UK retailer JJB Sports.

EQT buys UC4 from Carlyle

EQT has wholly acquired Austrian software company UC4 from the Carlyle Group.

HgCapital sells wind portfolio to Munich Re

HgCapital has sold its operating UK onshore wind portfolio to MEAG, the asset management arm of insurance group Munich Re.

Almi in SEK 7m round for InCoax

Almi Invest and Norrlandsfonden have participated in a SEK 7m round for Swedish broadband business InCoax Networks.

Northstar Ventures backs TryLife

Northstar Ventures has invested ТЃ145,000 in UK online educational drama producer TryLife.

Bridgepoint-backed Care UK makes acquisition

Bridgepoint-backed Care UK has acquired residential care provider Whitwood Care from family-owned Michael Wheatley Holdings.

Cherie Blair's PE fund raises £4.5m towards £75m target

Allele, a healthcare-focused private equity fund set up by Cherie Blair, is understood to have raised 6% of its ТЃ75m target.

Accel-backed 99designs buys 12designer from Grupo Intercom

Online graphic design market-place 99designs, backed by Accel Partners, has bought Berlin-based creative market-place 12designer, owned by Spanish venture capital firm Grupo Intercom.

Kelso Place-backed MDNX acquires Octium

Kelso Place portfolio company MDNX has wholly acquired UK-based IT services provider Octium.

North East Accelerator provides £120,000 for Deminos

Finance for Business North East Accelerator Fund, managed by Northstar Ventures, has provided ТЃ120,000 to HR outsourcing company Deminos in a third funding round.

Gresham's ICR Integrity bolts on MOSS

Gresham-backed oil and gas services provider ICR Integrity has acquired UK-based mechanical services provider MOSS.

Accel Partners and FirstMark Capital back OpenGamma series-C

Accel Partners and FirstMark Capital have reinvested in UK-based financial analytics company OpenGamma, as part of a $15m round led by ICAP and its early-stage funding programme Euclid Opportunities.

Bridges-backed Babington bolts on Training for Today

Bridges Ventures portfolio company Babington Business College has acquired Michael John Training Limited, trading under the name Training for Today.

Fr2 Capital exits Vilebrequin to G-III Apparel

Fr2 Capital has exited Switzerland-based swimwear designer Vilebrequin to listed American trade player G-III Apparel Group.

Sovereign Capital's City & County makes ninth acquisition

Sovereign Capital-backed City & County Healthcare Group has acquired UK domiciliary care provider Help at Home, in a deal that marks the company's ninth bolt-on since 2009.

PE-backed Biffa attracts £520m bid

A consortium of investors is thought to be planning a ТЃ520m bid for UK-based waste management business Biffa, a Montagu portfolio company.

Rutland earns 1.5x on Pulse Home exit

Rutland Partners has sold branded goods provider Pulse Home Products to Jarden Corporation, a consumer goods producer.

LDC-backed A-Gas makes fourth acquisition

LDC-backed A-Gas International has bought US-based halocarbon management specialist RemTec International, supported by fresh equity from LDC.

H2 picks up paper businesses from Norske Skog

H2 Equity Partners has acquired Netherlands-based paper mill Parenco and recovered paper business Reparco from Norwegian paper producer Norske Skog.

PE-backed Télédiffusion sells Finnish subsidiary

Télédiffusion de France (TDF), a French operator of broadcast towers backed by a private equity consortium, has sold its Finnish operation Digita Oy to First State Investments, the overseas investment unit of the Commonwealth Bank of Australia.