Genesis Capital

Genesis holds EUR 150m final close for GPEF IV

Czech Republic-headquartered GP reached its hard-cap with a EUR 15m commitment from the EBRD

Genesis buys majority stake in HC Electronics

GP is investing in the electronics manufacturing firm via its EUR 40m Genesis Growth Equity Fund I

Genesis Capital raises EUR 101m in first closing of GPEF IV

Fund aims to raise up to EUR 150m from institutional investors by the end of 2021

Genesis closes first growth fund on €40m hard-cap

Vehicle was launched in May 2018 and held a first close in October 2019

Genesis acquires Home Care Promedica

GP is investing from its Genesis Growth Equity Fund I, a vehicle that held a first close on €31m in 2019

Genesis buys majority stake in R2B2

Deal is the first from the GP's Genesis Growth Equity Fund I, which is targeting €40m

GP Profile: Genesis Capital

Managing partner Ondřej Vičar discusses the launch of the firm's latest fund, as well as portfolio management and investing during the coronavirus pandemic

Genesis Capital launches €150m fund

GPEF IV will focus on investments in small and medium-sized companies with high growth potential

Genesis holds first close on €31m for GGEF I

Genesis Capital registered the fund in May 2018 and is targeting €40m for the vehicle

Genesis buys 11 Entertainment Group

11 Entertainment Group is the eighth investment from Genesis Private Equity Fund III

CEE GPs use minority transactions to boost dealflow

Dealflow bolstered by the creativity of private equity firms, willing to team up or take minority stakes

Genesis backs IT specialist CN Group

GP deploys capital from its Genesis Private Equity Fund III, which closed on €82m in September 2016

Genesis targets close and launch in 2019

Growth fund will focus on companies with revenues of up to €15m and EBITDA of up to €2m

Genesis hires senior investment analyst

Tomáš Sýkora will be responsible for finding investment opportunities and overseeing portfolio companies

Genesis hires two for investment team

New hires will reinforce the investment team and will be active in planned fundraising

Genesis to launch €40m growth fund

Fund will focus on smaller companies with growth potential present in the Czech and Slovak markets

Genesis appoints Janovský as CFO

Petr Janovský joins as chief financial officer along with new investment analyst Adam Ruta

Genesis exits POS Media Group

Deal comes just a year after Genesis acquired the firm via its Genesis Private Equity Fund III

Genesis, Avallon acquire Triton-backed Eqos Energie operations

Once completed, the Czech and Polish companies will operate under the new brand Stangl Technik

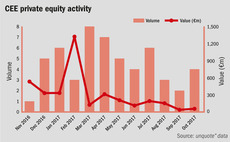

CEE closes out 2017 with strong investor confidence

Fundraising and deal activity both increased in the region during 2017

Genesis acquires stake in D2G

GP draws equity from €80m Genesis Private Equity Fund III to finance the transaction

Genesis takes minority stake in Czech retail merger

Genesis will tap its vehicle Genesis Private Equity Fund III to provide financing for the new company

Genesis acquires 47% of POS Media Group

Transaction is the second investment made from the Czech GP's third fund, which raised more than €80m last year

Mega-deals cap good year in CEE

Region registers two €500m-plus deals in the final quarter of a strong year for private equity