DACH unquote

BlackFin backs finanzen.de

BlackFin Capital Partners has invested in finanzen.de AG, taking a majority stake in the business.

SEP backs €16m Mister Spex round

Scottish Equity Partners (SEP) has joined a €16m round of funding for German online optician Mister Spex.

Dubai International’s Mauser extends 96% of debt

German industrial packaging manufacturer Mauser, which is owned by Dubai International Capital, has extended the maturities of 96% of its €695m senior debt, revolver and acquisition facilities.

PAI partners sells FTE Automotive to Bain, reaps 3.3x overall return for fund III

PAI partners has agreed to sell its 90% stake in German hydraulic clutch and brakes provider FTE Automotive to Bain Capital in a secondary buyout.

Equita acquires MEN Mikro Elektronik

German private equity house Equita has acquired MEN Mikro Elektronik, an embedded electronics manufacturer, in a deal that values the company at €25-50m.

Mandarin Capital Partners to invest in DACH region

Sino-European investor Mandarin Capital Partners (MCP) has opened a Frankfurt office as part of its widened focus.

Investment AB Kinnevik et al. invest $20m in Foodpanda

Investment AB Kinnevik and Phenomen Ventures have led a funding round in excess of $20m for Foodpanda, a global food delivery service.

ECM acquires MediFox Group

ECM Equity Capital Management has acquired MediFox Group, a German software provider for the care industry, alongside management as part of a succession solution.

Steadfast Capital hires three

Steadfast Capital has expanded its investment team by recruiting Friedrich Ysenburg, Tim Ottenbreit and Sandra Stohler.

PE-backed Kion Group to list

German forklift manufacturer Kion Group, backed by KKR and Goldman Sachs Capital Partners, is considering an initial public offering, according to reports.

Permira sells more Hugo Boss shares

Permira is to sell seven million shares, or a 10% stake, in German high-end fashion house Hugo Boss, according to reports.

DACH unquote” May 2013

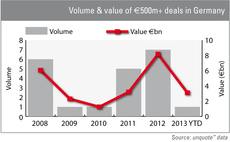

CVC’s €3bn buy-back of Ista in April caused much excitement for German private equity in 2013, though a deeper look at the figures reveals that the asset class had got off to a bad start this year.

Invision buys Kraft & Bauer

Swiss firm Invision Private Equity has bought German fire protection business Kraft & Bauer Brandschutzsysteme (K&B) as part of a succession solution.

Charterhouse buys Armacell for €500m

Charterhouse has agreed to acquire German insulation company Armacell from Investcorp in a €500m secondary buyout.

Springer Science sale back on

Germany could be home to another mega-buyout this year following news that EQT is in renewed talks with private equity investors over a potential sale of German publishing business Springer Science.

Germany: large-cap deals on the rise

CVC’s €3.1bn buy-back of German metering business Ista this month has sparked speculation about a revival of Germany’s large-cap market.

Zukunftsfonds Heilbronn, HTGF et al. back Compositence

Zukunftsfonds Heilbronn has become the lead investor in German carbon-fibre components company Compositence following a capital increase round that also included fresh investment from High-Tech Gründerfonds (HTGF) and Mittelständische Beteiligungsgesellschaft...

VC-backed GetYourGuide acquires Gidsy

GetYourGuide, a portfolio company of Profounders Capital, Spark Capital and Highland Capital Partners Europe, has acquired Berlin-based Gidsy, a peer-to-peer platform backed by Sunstone Capital, Index Ventures and private investors.

DBAG invests in Inexio

Deutsche Beteiligungs AG (DBAG) has invested €10.6m of growth capital in German broadband connections provider Inexio Informationstechnologie und Telekommunikation KGaA.

Yellow&Blue et al. back Romo Wind

Yellow&Blue Investment Management, ABB Technology Ventures and b-to-v Partners have invested €4.8m in Swiss wind farm optimisation company Romo Wind, alongside the business's founders.

AIFMD passed into German federal law

Germany has passed legislation for the implementation of the Europe-wide AIFM Directive into federal law, following a year of intense campaigning by representatives of the private equity industry.

CVC's Evonik begins listing process in Frankfurt and Luxembourg

CVC-backed Evonik Industries has begun its much anticipated listing process by issuing its 466 million shares simultaneously in Frankfurt and Luxembourg.

BayBG joins HTGF and Bayern Kapital in €1m GME series-A

BayBG has joined existing investors High-Tech Gründerfonds (HTGF) and Bayern Kapital in a €1m series-A round for German laser and light systems provider German Medical Engineering (GME), alongside private investors.

Afinum holds final close for fourth buyout fund

Afinum has held a first and final close for its fourth mid-cap buyout fund, Afinum Siebte Beteiligungsgesellschaft mbH & Co KG, on its €280m hard-cap.