DACH unquote

Rigeto Unternehmerkapital buys majority stake in Crusta Nova

GP plans to support the Germany-based seafood and fish retailer in growing its B2B and B2C channels

VCs sell stakes in Rhebo to trade

eCapital, TFS, Montan-Ventures-Saar and VNG Innovation previously backed the cybersecurity company

VCs in €15m funding round for Compeon

Iris Capital, NRW Bank and the Qatar Development Bank led the round for the SME financing platform

Apax, DTCP, Summit exit Signavio

Apax Partners, Deutsche Telekom Capital Partners (DTCP) and Summit Partners have sold their stakes in Germany-based business process management software business Signavio to SAP.

Blue Horizon hires Köktentürk

Sedef Köktentürk joins as a managing partner and chief operating officer and will focus on areas including impact

Arcus, Aheim acquire minority stake in Milch & Zucker

Arcus could increase its share to a majority stake in future, the GP said in a statement

HQIB, Cadence Growth back merger of Horn & Cosifan, PK Office

GPs intend to support a buy-and-build growth strategy for the IT service companies

Bid Equity's XClinical acquires Carenity

GP is currently following a buy-and-build strategy for the Germany-based clinical software platform

VC-backed Mister Spex buys Tribe

Online optician has previously received VC funding from investors including Grazia Equity and Goldman Sachs

IBB, Picus-backed Getsurance sold to trade

Insurtech company raised €2m in 2017 from Picus Capital and IBB but filed for insolvency in 2020

VC-backed Ubitricity sold to Shell

Investors including Earlybird and IBB previously backed the electric vehicle charging startup

Xplorer Capital, Futury Venture lead $22m round for Wingcopter

Germany-based delivery drone developer is also backed by Hessen Kapital via Hessen Kapital III

Toscafund leads €25m round for Elinvar

Existing investors Goldman Sachs Growth, Ampega and Finleap also back the round

EMH sells stake in Native Instruments

SBO to Francisco Partners sees EMH and Native Instruments' management retain a minority stake

InfraVia's Celeste acquires PE-backed VTX Telecom

Exiting their stakes, Iris and Siparex first invested in the telecoms service in 1999 and 2005 respectively

VCs in $50m round for Maps.Me

Navigation and travel app was bought by Parity.com subsidiary Daegu for around €16.65m in 2020

Partech sells stake in Once Dating to trade

French VC first invested in the dating app in 2015 via its first Partech Entrepreneur fund

Blue Horizon Ventures closes debut fund on €183m

Food-technology-focused VC was founded in 2018 and has so far made 18 investments

Sequoia Capital to invest in Auto1 prior to IPO – report

IPO of used car trading website could generate proceeds of €1bn, the company said in a statement

Rhein Invest buys majority stake in Spiegel Institut

Investment in the consumer research consultancy is part of a succession solution

Index Ventures leads $125m round for Personio

VCs including Meritech Capital also back the round, which values the HR software at $1.7bn

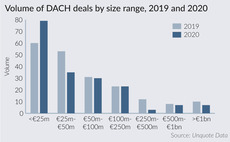

DACH small-cap deals weather the storm

Small-cap dealflow remained fairly stable in the DACH region in 2020, despite the coronavirus crisis

Fidelium Partners acquires RET

Parent company Reiff Group said in a statement that the sale is part of its ongoing realignment plan

Heal Capital closes debut fund on €100m

Healthtech-focused VC sees opportunities in the developing European market, managing director Christian Weiß tells Unquote