Mid-market fuels surge in French buyouts

France's buyout market reached its second most active period in six years in the three months to May, buoyed by a strengthening mid-market. Chris Papadopoullos reports

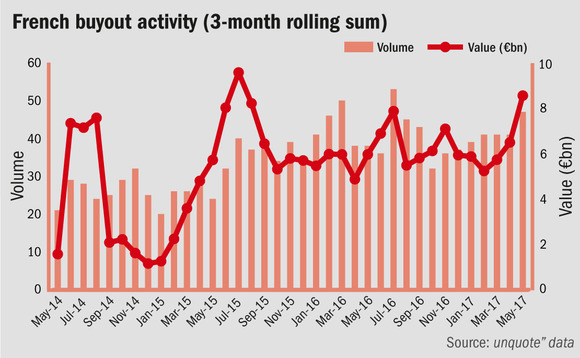

The French buyout market has a new spring in its step. In the three months to May, €8.6bn was invested in French buyouts, the highest three-month period since the three months to July 2015, and second highest since the same period to July 2011. It improves further on the plateau of €6bn that deal values have tended to hover around for the last two years.

A steadily increasing stream of deals has been coming through in recent months, with numbers rising or staying the same in each rolling three-month period since October last year. From a trough of 32 deals in the three months to October, deal numbers climbed to reach 47 in the three months to May. While volume and aggregate value have been lifted by the upper-mid-market and large-cap deals (>€250m), which have a disproportionate impact on deal values and can fall back as suddenly as they jump, a gradual strengthening has taken hold in the core mid-market (€50-250m).

The €2.2bn's worth of mid-market deals completed in the three months to April is the highest since 2011. It was invested in 19 buyout deals, the highest number in six years. Since early 2015, the core mid-market has experienced an upward trend despite some sizeable swings in activity.

In comparison, dealflow at the low end of the market (<€50m) has remained fairly stable, with deal numbers hovering mostly between 15-25 for the last few years and deal value staying between €300-700m.

A hot spell in the buyout market is in line with a recent strong run of fundraising. As reported by unquote", French funds raised €24.7bn last year – a record amount and far above the amounts raised in 2015 and 2014. Leading the pack was Ardian, which closed three funds in excess of €1bn, the largest being a $14bn secondaries fund. Private equity houses in the rest of Europe are also finding it easier to raise cash, spurred on by a stronger economy, large piles of institutional money looking for investments, and government initiatives.

Ardian has completed the most French deals this year with six buyouts, the largest of which was the acquisition of retailer Prosol Gestion, estimated to be around €1.3bn. Two of those deals have been in the core mid-market. In deal numbers Ardian is followed by Ixo Private Equity with five deals and Naxicap Partners and Seventure with four deals.

Two sectors currently stand out as performing above trend. Consumer services registered its largest aggregate deal value in the three months to May for at least six years, with €3.2bn invested in eight deals. The tech sector also stood out, with 10 deals taking it to its busiest three-month period since 2011.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater