Benelux Unquote

Gimv-backed Brakel acquires Argina Technics

Gimv acquired a majority stake in Dutch group Brakel in September 2015

Deal in Focus: Kartesia in Desmet Ballestra debt-for-equity swap

unquote" looks back on alternative lender Kartesia's progressive takeover of the Belgian-Italian group

Mentha takes majority stake in petrol supplier Nefco

Transaction marks the second deal within a month for the Dutch private equity firm

Kartesia takes over Desmet Ballestra in lender-led deal

New owner will look to stabilise the group's activity and ensure continuity

Thuja closes second fund on €34m

Thuja's second vehicle is almost double the size of its €19m predecessor fund

Gimv in talks to sell Lampiris to Total

Gimv invested €40m in Lampiris via its Gimv XL buyout fund alongside SRIW in 2013

Gilde closes fourth fund on €250m hard-cap

Gilde Healthcare focuses on medtech, digital health and therapeutics in Europe and the US

Real Impact raises €12m series-A from Gimv et al.

Backers include venture capital firms Fortino Capital and Endeit Capital

3i reaps £89m in Basic-Fit IPO

3i invested €97m in the company in 2013 through an MBO valuing it at €275m

Karmijn acquires art lessor Kunst.nl

Kunst.nl is the first investment made via Karmijn's second fund, Karmijn Kapitaal II

Karmijn Kapitaal closes second fund on €90m hard-cap

GP's first fund, Karmijn Kapitaal I, was launched in 2011 and has been fully invested

LSP closes $280m life sciences venture fund

Vehicle closes more than one year after holding its first close on €80m

Vendis Capital acquires Noppies

Vendis made the acquisition via its second fund Vendis II, which recently closed on its €180m hard-cap

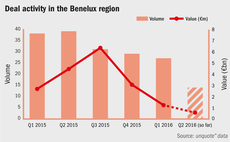

Usual suspects working hard in sedate Benelux market

Trend of declining dealflow in the region shows little signs of change, though buyout multiples return towards lower long-term averages

Safinco takes 24% stake in Gimv's Vandermoortele

Family shareholders will regain full ownership of the business following the transaction

Menu Next Door gathers €1.75m in seed round

Belgian startup recently launched its activity in London, complementing Paris and Brussels

Vendis closes Vendis II fund on €180m hard-cap

Second buyout fund, launched in 2015, closes ahead of its €150m target

Sovereign backs MBO of Xendo

Life sciences consultancy will undertake a buy-and-build growth strategy

Showpad secures $50m in series-C round led by Insight

Belgian tech company more than doubled its revenues for the third consecutive year in 2015

3i's Basic-Fit announces intention to float

Company could be valued at up to €1bn for the listing, which could take place by year-end

Pamplona-backed Beacon acquires Ascendos

Portfolio build-up will enable Beacon Rail Leasing to expand its fleet of locomotives

Endeavour et al. lead $25m series-D for Endostim

Endeavour Vision led the funding round alongside Gimv and Wellington Partners

3i and Deutsche AM acquire TCR in €200m SBO

Both partners are acquiring the business from previous owners Chequers Capital and Florac

Bencis Capital acquires majority stake in BRB

Buyout is financed via Bencis's fourth buyout fund, the €408m Bencis Buyout Fund IV vehicle