DACH Unquote

Heal Capital names Weber as managing partner

Eckhardt Weber will manage the firm along with managing director Christian Weiß

Reiff Reifen files for insolvency

Bain's tyre wholesale and retail group European Fintyre Distribution bought the company in 2017

Nord Holding-backed Ruf Group buys Bruno

GP invested in the bed retailer in 2016 and Bruno is the company's first add-on acquisition

DBAG-backed STG to buy majority stake in IMD

Third add-on for the telecoms service is subject to competition authority approval

2020 Outlook: DACH buyout volume stalls amid macro uncertainty

Overall dealflow plateaued, with just one buyout more recorded in 2019 compared with 2018

PartnerFonds sells MusikProduktiv to trade

GP invested in the company in 2015 and increased its stake to 60% in December 2017

EQT, Omers buy Deutsche Glasfaser from KKR

Company has a reported enterprise value of €2.5-3bn and will merge with EQT portfolio company Inexio

Consortium in CHF 23m series-C for Lunaphore

Fresh capital will be used for market and product expansion in the US and Europe

Novacap and CDPQ back Eddyfi

Eddyfi has used the financing to assist with the acquisition of Germany-based market peer NDT Global

Mutares-backed Balcke-Dürr buys Loterios

Acquisition of the Italy-based pressure equipment manufacturer is the fourth add-on since 2016

VR Ventures announces €40m first close for debut fund

Fund is backed by banks including Berliner Volksbank and will focus on financial and property technology

LEA Partners invests in Enscape

Founders and HTGF will retain their stakes in the architecture and construction software provider

Ergon-backed Opseo buys ZBI NRW

Regional group was previously part of ZBI and will open new clinics in North Rhine-Westphalia

Aurelius buys Woodward's RPS and protection relay businesses

GP has acquired the Germany- and Poland-based companies from their US-headquartered parent

BWK sells 33.3% stake in Joma-Polytec

GP invested in the manufacturer in 2002 and has sold its stake to the company's family owners

SHS backs €6m round for Selfapy

SHS joined the round as a new investor in the online mental health treatment company

Triton buys 76% stake in Renk

Parent company VW began looking for strategic options for the company in May 2019

Acton hires new principal

Elizabeth von Lichem joins the Germany-based venture capital investor from the EIB

Insight Partners et al. back €27m series-C for SimScale

Engineering simulation software provider was also backed by a number of existing investors

Mercurius exits GVG Glasfaser

GP bought a stake in the broadband provider in 2014 and began considering strategic options in 2019

Kamet in €6m round for Medloop

Digital health app plans to continue expanding in the UK and Germany following the investment

IK-backed Schema buys software provider Docware

Combined group expects to boost its growth and enlarge its customer base to 1,000 clients across 25 countries

EQT Ventures backs $22.3m round for Frontify

Brand management platform plans to use the fresh capital to expand internationally and in the US

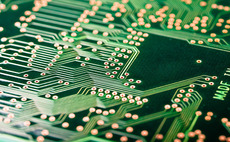

HQIB acquires majority stake in ATX

HQIB is seeking add-on acquisitions for ATX, a producer of electronic test adapters