Unquote

Bain exits Parts Holding Europe to D'Ieteren for EUR 1.7bn

The GP withdrew an IPO for the autoparts retailer in 2021

LSP closes LSP 7 at EUR 1bn

The GP says it is the largest life sciences venture capital fund ever raised in Europe

Nuveen closes impact fund on USD 218m

GP could return to market for Fund II in 2022 or early 2023 given current deployment opportunities

Lauxera closes first health tech fund on EUR 260m

Debut fund will invest EUR 20m-40m in European and US health technology companies

BC Partners announces EUR 6.9bn fundraise for BC XI

Final close fell below the original target;Т GP expects to return to market for its next fund in H2 2023

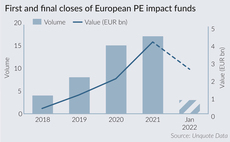

PE impact fundraising surpasses EUR 4bn in 2021

Figures from Unquote Data reflect the increasing prevalence of impact and impact-driven deals

Tikehau records EUR 6.4bn in fundraising in 2021

GP deployed EUR 5.5bn from its private equity, private debt and real estate funds in the same year

Coller to close USD 1.4bn debut credit secondaries fund

GP launched its first dedicated secondaries fund in May 2021 and has commitments from around 30 LPs

Split the difference – corporate divestitures set records

Firms have taken advantage of favourable conditions for M&A, including cash-rich and ever-bolder PE funds

EMEA M&A surges in 2021

More than 10,500 M&A deals were recorded in 2021, worth a combined USD 1.54trn

Astorg promotes Le Baron and Veber to partner

Charles-Hubert Le Baron and Thibault Veber have worked at Astorg for a combined 16 years

Letter from the editor

Joao Grando replaces Greg Gille as Unquote editor

A farewell from the editor

Greg Gille leaves Unquote after more than 11 years with the publication, including five as editor

GP Profile: Triton lays out ESG plans

ESG head Graeme Ardus and recently appointed head of sustainable investing Ashim Paun detail the firm's approach to ESG

Planet First seeks sustainability investments ahead of EUR 350m fund close

Managing partner and co-founder FrУЉdУЉric de MУЉvius speaks to Unquote about the firm's evergreen fund and its investment strategy

Highland, HPE Growth-backed WeTransfer announces IPO pricing

First day of trading is expected to commence at the end of this month on Euronext

Värde announces three partner promotions

Alternative investment firm has promoted Jim Dunbar, Aneek Mamik and Carlos Sanz Esteve to partner

Permira merges Kedrion, BPL

Combined biotechnology group will have more than EUR 1.1bn in revenues and 4,000 employees

EQT sets EUR 20bn target size for EQT X

Flagship fund's target is EUR 5bn higher than its predecessor, which is currently around 75-80% invested

Buy-and-build a "super opportunity" for PE in healthcare services – panel

Dermatology, ophthalmology and diagnostic imaging all present attractive consolidation opportunities, panellists said

S4Capital, Stanhope launch S4S Ventures fund

S4Capital and Stanhope Capital will act as GPs for the marketing and advertising technology fund

Petershill IV closes on USD 5bn

Petershill Partners is operated by Goldman Sachs Asset Management and buys minority stakes in GPs

TPG raises USD 835m in USD 9bn IPO

TPG sold 28.3 million shares, raising USD 835m at a valuation of USD 9bn

ArchiMed launches second mid-cap fund

Med Platform II will aim to make 8-12 investments in the mid-market, and will be larger than its EUR 1bn predecessor