Unquote

The Bolt-Ons Digest – 1 April 2022

NorthEdge's Correla; LDC's Omniplex; QPE's Encore; Cinven's Barentz, Tenzing's Jeffreys Henry, and more

AP Moller, Biogroup among final bidders for Waypoint's Affidea

Final offers for the pan-European outpatient group are expected in a couple of weeks

Lightrock announces promotions, board appointments

Impact investor expects to turn its focus to new deals in 2022 and grew its team by 30% in 2021

Azalea holds USD 100m first close for sustainability fund-of-funds

Fund-of-funds will invest in managers focused on ESG and positive environmental and social impact

CVC's Amsterdam IPO move adds impetus to calls for LSE reform

CVC Capital Partnersт reported preference for Amsterdam as a potential home for its shares shows that Londonтs regulatory regime still needs to be far more flexible, several sources said.

CD&R appoints European portfolio procurement director

Marta Benedek joins Clayton, Dubilier & Rice following a 20-year stint at General Electric

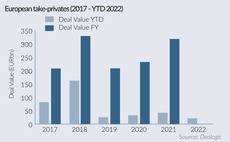

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

The Bolt-ons Digest – 18 March 2022

KKRтS Biosynth Carbosynth, Agilitasт Cibicom, Apaxтs Graitec, Cairngorm's Verso, Altor's Trioworld, and more

KKR hires Workday co-CEO as tech advisor

Chano Fernandez will focus on the enterprise application software segment in Europe and the US

Gilde Healthcare closes fourth buyout fund on EUR 517m

Double the size of its predecessor, the new vehicle was oversubscribed and saw nearly all Gildeтs existing LPs investing

I Asset Management, BaltCap acquire Dr Vet

IAM has a specialist Petcare Growth Fund

ESG from 'nice to have' to prerequisite for almost all LPs – survey

Adams Street Partnersт 2022 Global Investor Survey gauged LPsт views of 118 LPs globally

Sponsors kick off 2022 with buyout volume down 13% year-on-year

Energy costs, inflation and war in Ukraine cloud deal activity but value holds up with average deal size on the rise

Cinven buys Bayer's Environmental Science Professional for EUR 2.4bn

It is the third industrial carve out by the GP since 2020

EQT invests in SNFL and IFG in second deal via Future fund

The fund launched in October 2021 with a target of EUR 4bn

HarbourVest closes ninth fund-of-funds on USD 1.6bn

New Europe and Asia Pacific vehicle will also allow secondary transactions and direct co-investments

Pantheon poaches Amyn Hassanally from Coller Capital

Hassanally will join as global head of private equity secondaries

GP Profile: BC Partners looks to steady deployment ahead of next fundraise

Head of IR Alexis Maskell details the GP's plans to lay strong foundations for when it next hits the road, possibly in H2 2023

Large-cap sponsors join philanthropic fund-of-funds

Advent, Bain, Cinven, Hg, Nautic and Permira join the scheme

BlackRock eyes new Secondaries & Liquidity Solutions fund

Strategy makes global mid-market secondaries deals and provides liquidity at GP level

ECI announces hires at IR, origination and investment teams

Adam Whitfield joins the mid-market firm as investor relations manager after close to five years at Rede Partners

Onex eyes fundraise for sixth fund

Predecessor vehicle was expected to be 78% deployed in December 2021 after acquiring TES Global

Pictet holds first close for healthcare fund-of-funds

Around 40% of the target USD 400m will be allocated to co- and direct investments

Lightrock gears up for Climate Impact Fund

Impact investing GP raised USD 900m for its Lightrock Growth Fund I vehicle in 2021