Unquote

Mizuho acquires placement agent Capstone

US investment bank intends to strengthen its service offering for financial sponsors

Sequoia, Fidelity in EUR 628m investment round for Bolt

Ride-hailing service reaches a valuation of EUR 7.4bn, up from EUR 4bn at its last funding round in August 2021

Nordic Capital invests in PE-backed RLDatix

Existing investors TA Associates and Five Arrows will retain their majority stake in the business

Tiger Global, TCV et al. in EUR 486m Series D for Qonto

Tiger Global and TCV led a Series D round alongside eight new investors

KKR closes USD 4bn healthcare fund

Health Care Strategic Growth Fund II is the successor to HCSG I, which closed in November 2017 on USD 1.45bn

PE activity reaches EUR 392bn in record-breaking 2021

Q4 may have shown signs of a market slowdown, but 2021 nevertheless stands out as a phenomenal year for PE deployment across Europe

Permira to offload 6.5% stake in Dr Martens

Permira will offload approximately 6.5% stake in Dr Martens via accelerated bookbuild

Earth Capital hires new head of investment

Sustainable private equity firm Earth Capital promotes Avent Bezuidenhoudt to head of investment

TPG sets pricing for USD 9.5bn IPO

Private equity firm hopes to raise USD 877m by selling 28.3 million shares on the Nasdaq exchange

Azalea holds USD 805m close for Altrium II

Vehicle is the second in Azalea Investment Management's PE fund-of-funds strategy

IK Partners acquires e-commerce specialist Stein HGS

IK acquires its stake in the e-commerce company from Lennertz & Co, which will reinvest

Pollen Street, BC Partners consider IPO for Shawbrook Bank - report

UK-based retail and commercial bank could achieve a valuation higher than GBP 1bn if floated or sold this year, according to reports

Happy Holidays from the Unquote team

Check out a selection of our most impactful recent content, before the team returns on 4 January to resume covering the latest European PE news

CVC invests in FutureLife

CVC acquires a co-controlling stake alongside current investor Hartenberg Holding

Clessidra acquires Impresoft

Impresoft was expected to have an enterprise value between 9x-11x its 2021 EBITDA

Adams Street closes 2021 Global Fund on USD 832m

Adams Street's predecessor fund-of-funds held a final close in December 2020 on USD 823m

Hayfin exceeds EUR 2bn target for Special Opportunities Fund III

Credit fund will target opportunities arising from post-pandemic dislocation

2022 Preview: Sponsors toast to incredible year, but remain wary of hangover

Many sponsors are anticipating that 2022 could be just as busy as 2021, in spite of mounting headwinds

ArchiMed buys lab analysis company Carso

Selling shareholders include private equity firms EMZ Partners, Etoile ID, Unigrains, Raise and Siparex

Blackstone registers ninth fund

Previous flagship fund, Blackstone Capital Partners VIII, held a final close in September 2019 on USD 26bn

Atomico et al. in USD 200m Series D for Infarm

Vcs raised USD 200m in Series D for Infarm at a valuation of over USD 1bn

MVI closes MVI Fund II above target

MVI Advisors has held a final close for its second fund on SEK 1.1bn

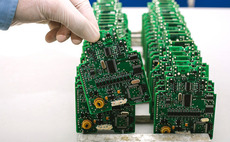

Argos Wityu acquires majority stake in Groupe Fedd

GP bought its 90% stake in the electronics specialist via Argos Wityu Mid-Market VIII

VC firm BGV kicks off fundraise for second growth fund

Upcoming fund will invest 80% of its target size in BGV's existing portfolio companies