Unquote

Clayton, Dubilier & Rice hires European ESG head from FTI Consulting

Hannah-Polly Williams is the second addition to the US PE firm’s ESG initiatives group in the past six months

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

The Bolt-Ons Digest – 17 April 2023

Unquoteтs selection of the latest add-ons with Triton's BFC Group, Seven2's Groupe Crystal, Palatine's FourNet and more

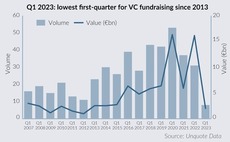

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Houlihan Lokey hires new capital markets MD from Numis

David Kelnar told Unquote that the firm is seeing a growing pipeline of companies looking to fundraise

Spending bottom dollar: Valuation gaps take Q1 buyout levels back to 2009

Sponsors make just 95 buyouts in Europe in the first quarter - a figure not seen since Sony sold 12m floppy discs in one year

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

Alcentra revives direct lending push with multi-billion fundraising drive

Direct lender registered its fourth European fund in Luxembourg in January 2021

KKR holds USD 8bn European Fund VI buyout fund close with 12.5%-plus GP commitment

European Fund VI will deploy equity tickets of EUR 250m-750m in six core sectors

VC Profile: Target Global assesses B2B opportunities in final stretch of current fund deployment

Nearing full deployment for its second growth fund, pan-European VC firm outlines plans to back defensive B2B models and institutionalise its co-investment strategy and LP base

EQT closes LSP Dementia on EUR 260m hard cap

Series A-focused fund exceeded its EUR 100m target and extended fundraising after increased LP interest in its strategy

Armen eyes 2023 final close for debut fund after first close and stake sale

Sponsor sells 20% stake in itself to family offices as EUR 400m fundraise continues

Half of LPs allocating to impact from generalist pool as market matures – Rede Partners

Jeremy Smith and Kristina Widegren speak to Unquote about key takeaways from the private capital adviserтs Private Markets Sustainability and Impact Report

European sponsors sidestep panic, concede gloom over bank woes

Fallout from Credit Suisse collapse adds to slew of macroeconomic challenges for PE dealmaking and fundraising

Deals face further financing uncertainty after Credit Suisse rescue

Delayed return of stabilized M&A conditions expected, advisors say; mid-cap transactions stand to fare best

The Bolt-Ons Digest – 20 March 2023

Unquote’s selection of the latest add-ons with Cinven's ETC, PAI's Apleona, TA Associate's Fairstone, and more

Lenders sway fate of auctions in volatile LBO market

Vendors increasingly sounding out lenders before bidders to navigate uncertain M&A landscape

Beyond Impact aims for EUR 100m close for alternative protein fund

Article 9 fund held EUR 25m first close in early 2022; targets stakes in non-animal proteins and ingredients

'The start-ups are just about alright': SVB fallout throws focus on UK tech capital demands

Silicon Valley Bank's demise might cause a small dent in confidence but should not have wider impact on the country's VC or tech sector

Unquote Private Equity Podcast: What's next for ESG – Fedrigoni case study

Harriet Matthews is joined by colleague William Cain to discuss ESG investing amid macro clouds and interviews Bainтs Ivano Sessa about the sustainability strategy for one of the sponsor's portfolio companies

Permira raises EUR 16.7bn for Fund VIII, 50% up on previous vintage

Final close comes in a market largely devoid of multi-billion fundraises from European managers in recent months

Glass ceiling shows first cracks in PE space

Greater focus on investment team gender equality and mentoring has shifted the balance, but room for progress remains

Clean capital: record impact fundraising creates pools of do-good money

Impact vehicles raised EUR 8.5bn last year, but 2023 is off to slow start with just two funds closed

Kompas VC seeks built environment tech opportunities, eyes second fund

Early-stage VC keen to expand cooperation with industry partners as it searches for investments to decarbonise the built environment, managing partner Sebastian Peck tells Unquote