Unquote

EU Foreign Subsidies rules hold specific challenges for PE

Sovereign wealth funds and pension funds commitments may trigger EC attention under new EU foreign subsidies regulation

TA Associates waltzes to USD 16.5bn fundraise

Seven-month raise for the US-based sponsor’s fifteenth vehicle bucks fundraising woes faced elsewhere

European LPs bullish on 2024 PE fund vintages – Coller Capital

LPs remain positive on PE but are considering increasing infra and private credit allocations, latest survey shows

BlackRock buys growth and venture debt provider Kreos

Global asset manager plans to broaden Global Credit business with fresh acquisition

From slash-and-burn to grow-and-earn: private equity changes tack

Rising cost of capital means value-creation will be vital for next decade of private equity, SuperReturn participants said

Keensight Capital opens US office

New Boston base will allow growth buyout investor to support US expansion of its portfolio companies

Investec acquires majority interest in corporate finance firm Capitalmind

Transaction will see the advisory firms fully integrating their M&A and corporate finance teams

Adams Street secures USD 3.2bn for newest secondaries programme amid LP stakes dealflow uptick

Private markets investor has seen LP stakes increase as a proportion of its deployment over the past year, partner Jeff Akers said

Unquote Private Equity Podcast: In conversation with... Fabio Ranghino, Ambienta

In an interview with Unquote, Ranghino discusses topics including ESG and the next phase of Ambienta’s growth

Pemberton hires head of Sustainable Investing

Alternative credit lender poaches Niamh Whooley from Goldman Sachs, where she led its fixed income ESG integration team

The Bolt-Ons Digest - 26 May 2023

Unquoteтs selection of the latest add-ons with H&F's TeamSystem, Nordic Capital's Regnology, 3'i's Dutch Bakery and more

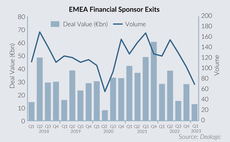

Q1 Barometer: Signs of a brighter future after dark times for European PE

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Hamilton Lane targets global impact opportunities with new USD 370m fund

Asset managerтs new fund will make direct investments and can take larger stakes than its USD 95m predecessor

Mediobanca acquires Arma Partners

Deal will increase Italian bank's investment banking fee pool by 30% as wider sector suffers from M&A slump

European VCs need to match actions to words by increasing funding to female-led companies

Women-led startups usually receive less than 2% of VC capital, but more diverse, defensible female-founded businesses emerging

Unquote Private Equity Podcast: Taking the plunge - GPs dive into alternative pools of capital

The Unquote team is joined by Thomas EskebУІk, CEO of private markets platform Titanbay, to discuss private marketsт search for alternative sources of commitments

EQT launches semi-liquid strategy for individual investors

Strategy will focus on PE and infrastructure and will be led by ex-Partners Group exec William Vettorato

Pantheon bullish on consolidation opportunities with fresh USD 2.4bn co-investment vehicle

Taking a cautious approach to valuation expectations, the sponsor is deploying its latest fund across small-, mid-cap and growth opportunities

Private markets investors combine forces to form Urban Partners

New platform with EUR 20bn AUM will look to address decarbonisation of cities via its real estate, venture capital, private equity and credit arms

AnaCap gears up for fourth private equity fund

Registered earlier this month, AnaCap IV follows the mid-market sponsor's EUR 850m, 2016-vintage predecessor

GP Profile: Ardian Expansion doubles down on generalist approach, eyes EUR 3bn Q2 fundraise launch

With its current EUR 1.5bn fifth fund almost at full deployment, Ardianтs Expansion strategy expects to benefit from LP appetite for its strategy ahead of EUR 3bn fundraise

Triton raises EUR 1.63bn for multi-asset continuation fund

Backed by HarbourVest and LGT, TIV CF will hold four Fund VI assets Assemblin, EQOS, Flokk and Unica

Women in VC: MMV's Brunet on tech opportunities and navigating volatile markets

Alix Brunet speaks to Unquote about the VC firmтs deal pipeline and how it is engaging with portfolio companies and new founders

Slice of pie: New entrants gobble up GP stakes in Europe

Armen, Hunter Point Capital, GP House and Axa IM rustle up new minority investments, as Inflexion and Coller sell