Southern Europe heats up with record levels of mega-deals

The volume and value of mega-deals in southern Europe reached their highest ever levels in the first three quarters of 2018. Alessia Argentieri reports

The heatwave that recently brought record-breaking temperatures to southern Europe has been mirrored by the region's private equity market, which recorded the highest volume and value of mega-deals ever reported in the first nine months of the year.

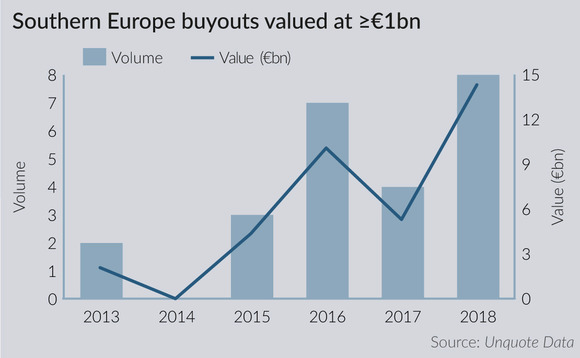

According to Unquote Data, eight deals valued at €1bn and above were inked in southern Europe between January and September 2018, for an aggregate value of €14.3bn. By comparison, only four mega-deals were recorded in the whole of the previous year, worth around €5.3bn, and seven in 2016, for a combined EV of €10.1bn. Furthermore, southern Europe is ahead of all regions for mega-deal volume except France, which recorded 11 buyouts of €1bn+. In terms of aggregate value, the region has outperformed France, CEE, DACH, the Nordic region and the UK, and is second only to Benelux.

More impressively still, total value reaches €18.1bn when also taking into account the PIPE investment made by CVC Capital Partners in Naturgy Energy Group, then known as Gas Natural Fenosa, a Spanish electricity and gas company listed on the Madrid stock exchange. The GP bought a 20% stake in the business from Repsol for €3.8bn, equal to a price of €19 per share. The consolidated capital gain generated for Repsol through the sale amounted to approximately €400m.

The positive market conditions that we have experienced in Italy have increased the confidence of international investors and attracted the interest of large funds able to fuel mega-buyouts" – Bruno Gattai, Gattai Minoli Agostinelli & Partners

"Despite some elements of political uncertainty," says Linklaters partner Fionnghuala Griggs, "we have recently seen intense M&A activity, particularly in the area of mega-deals. The increased activity levels are primarily driven by a strong financing environment, including abundant available debt, low interest rates, an ongoing focus on key sectors such as technology and pharma, and by a clear desire for cross-border deals throughout Europe."

The largest buyout recorded in 2018 in southern Europe was the acquisition of a majority stake in pharmaceutical company Recordati by a consortium led by CVC Capital Partners. The GP and its partners bought Fimei, the Recordati family's holding company that owns a 51.8% stake in Recordati, for €3.03bn. The price implies a total equity value for the pharmaceutical company of €5.86bn – equivalent to €28 per share and 12.9x its 2017 EBITDA.

According to Bruno Gattai, managing partner at Gattai Minoli Agostinelli & Partners: "The positive market conditions that we have experienced in Italy have increased the confidence of international investors and attracted the interest of large funds able to fuel mega-buyouts." Gattai's law firm advised CVC Capital Partners on the Recordati acquisition.

Notably, secondary buyouts accounted for five of the eight mega-deals closed in the first nine months of 2018 in southern Europe, compared with three in both 2017 and 2016, and only one in 2015.

Fertile ground

On a country-specific basis, Spain has proven very fertile ground for large deals, and counted three €1bn+ SBOs between January and September 2018, including the acquisition of Madrid-based cable operator Ufinet Spain bought by French GP Antin Infrastructure Partners from UK private equity firm Cinven. Elsewhere, in the month of July alone, Italy recorded two of the largest SBOs ever closed in the region, the acquisition of solar energy platform RTR for €1.3bn and the deal for power transmission belts manufacturer Megadyne, valued at around €1bn or 17x its €59m EBITDA.

The rich dealflow, fuelled by high levels of dry powder and a strong demand for large-cap deals, paints a picture of a booming environment. Nevertheless, changing circumstances may yet arise in the short and medium term.

"We are operating in a very positive financial environment for M&A activity and mega-deals," says Griggs, "but there are potential changes ahead and factors that might restrain activity in the future. These include trade tensions and geopolitical events such as uncertainty surrounding the outcome of Brexit. Thus, despite the high volume of deals and abundance of opportunities available, we shouldn't become reliant on favourable market conditions."

One such event on the horizon is the change in monetary policy that the European Central Bank is expected to embrace in the short term by abandoning its accommodative approach and increasing interest rates, which could lead to a very different market outlook.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds