Southern European mid-market showing signs of steady resurgence

After a quiet few years, the southern European mid-market has picked up to its highest levels of activity since Q2 2011 - and shows no signs of slowing down. Kenny Wastell reports

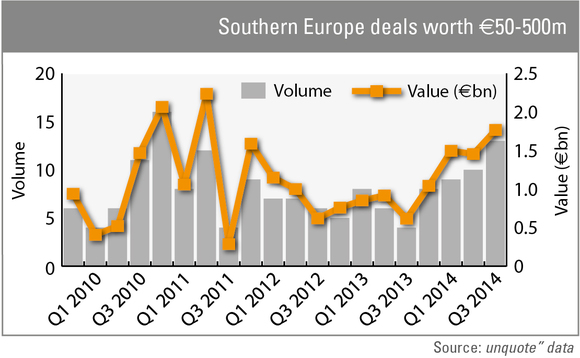

With the French and German economies stuttering in 2014, southern Europe has seen investor activity accelerate out of the slow lane. In particular, mid-market deal volume in the region has shot up. Between Q4 2012 and Q3 2013 there were 20 deals in the €50-500m range with that number doubling to 40 over the following year, according to figures from unquote" data.

Throughout the past 12 months, investors and industry insiders have been calling the bottom of the market in Spain and Italy - if not vocally, through the setting up of offices and teams dedicated to the region. EY, for instance, responded to improving conditions for M&A by establishing a team tasked with presenting southern European investment opportunities to UK clients across distressed funds, infrastructure and real estate.

The past year has also seen some GPs opening new offices in Spain; Munich-based mid-market firm Aurelius opened a Madrid office in October, KKR opened its office in the Spanish capital in February and Cinven recently revived plans for a local presence in the country. However, as argued by Remiggio Barroso, the partner who leads EY's aforementioned new team, most GPs' presence in Spain consist of a limited number of professionals, both looking at the Spanish market but also other territories.

Clearer roads up ahead

Barroso is certain southern Europe has wound its way beyond the most precarious roads. "There's a clear loss of fear surrounding the region," he says. "The concerns that any of these countries might break out of the Euro or default on their debt have gone. There is still a long way to go in terms of recovery but across all mediterranean countries the environment for deals is buoyant."

However, despite also sounding a broadly upbeat note, Francisco Gomez, a corporate finance adviser at Clearwater International, highlights the factors at play are not just macroeconomic ones. When discussing the Spanish market, he argues: "When you stop doing deals for more than four or five years there is a market that has to be sold. All the deals that have not taken place in the past few years will have to be done in the next few. Talking more broadly about M&A in Italy, Spain and Portugal - we need the activity to grow."

Increasing confidence and investor demand seems to have led to stronger appetite for larger deals, a trend particularly notable in Spain. In Q1 2013 there were only two Spanish deals in the €50-500m range, and three for the whole of H1 2013. Deal volume in the mid-market has increased slightly since - up to three in Q2 2014 and five for Q3 2014. However, the increase in total value has been far more marked. Spain's aggregate deal value within the €50-500m range sat at €80m in Q2 2013, down slightly from the previous quarter. This rocketed to €789m in the same period a year later before dropping slightly last quarter to €635m.

According to Clearwater's Gomez, conflicting forces at work in the Spanish market have led to the slightly erratic activity. An increasing amount of capital available for deployment is countered by a lack of suitable assets in the lower mid-market. Dealflow levels that meander in this way, between peaks and troughs in activity, are a reflection of overcrowding. The overall effect is an increasing number of local Spanish GPs are effectively being priced out.

Desperate times call for innovative measures

Activity in Italy has mirrored that in Spain; the aggregate value of deals in the €50-500m range was €1.1bn in Q3 this year, the highest total since Q2 2011, with deal volume at its peak level since Q4 2010.

Gomez and Barroso agree the broader investment across both countries can be attributed in large part to changing labour laws, which have brought greater flexibility and made the countries more competitive. Furthermore, when looking at Spain in particular, Clearwater's Gomez says the country was effectively forced to modernise its industrial sectors - and inadvertently gain an advantage over other countries - specifically because it was hit so hard by the financial crisis.

Additionally, an increased number of Spanish businesses have hedged their exposure to a volatile domestic market by focusing more on international operations, explains EY's Barroso. It is this characteristic that makes these assets more attractive to investors today. "Private equity funds are becoming more selective than they were prior to the crisis," elaborates Clearwater's Gomez. "They want to buy Spanish companies with a lot of non-Spanish exposure or diversified companies."

This also ties in with larger GPs' strategies of moving away from country-focused funds towards sector-specific vehicles in order to attract international large-cap trade buyers, says Barroso. "We are seeing the same trend in Italy," he adds. "Many international investors are going into Italy to buy consumer retail companies with good brands and good international footprints, so they can actually help them export and grow abroad."

Indeed, November alone has seen two €100m-plus deals for established "made in Italy" brands with designs for international expansion: Fondo Strategico and Qatar Holding's expansion deal for cured meat producer and distributor Inalca; and Investcorp's acquisition of Dainese, the manufacturer of protective clothing for motorcycling and extreme sports.

With international investors regaining an appetite for southern European assets, it remains to be seen whether the countries can produce enough businesses with the ability to grow into international powerhouses.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater