Benelux

KKR et al. in final exit from NXP Semiconductors

Company listed on Nasdaq in 2010, raising $476m and ushering a staggered exit process for its backers

Gimv takes majority stake in Summa

Roll cutter specialist group looks to increase its turnover by 50% by 2020 with Gimv's support

IK sells Vemedia to Charterhouse

IK acquired the business in 2012 in an SBO via the IK 2007 Fund

VC-backed Take Eat Easy placed under receivership

In spite of exceeding one million deliveries last week, the Belgian startup can no longer cover expenses

Main Capital backs Obi4wan and ObiLytics MBO

Deal marks the third transaction in the space of two months for the Dutch GP

Charlesbank to acquire Polyconcept from Investcorp

Investcorp led the €440m SBO of Polyconcept in 2005, taking over from BC Partners

Capricorn Venture launches €150m 2nd cleantech fund

The Netherlands-based VC expects to hold a first close by the end of 2016

Findos-backed Abit acuires Eurosystems

Main Capital invested €10m in the Dutch software provider in 2011, becoming majority shareholder

Main Mezzanine Capital backs The Valley's MBO

Alternative lender first provided a mezzanine loan in 2015 to finance the company's growth

Gimv-backed Brakel acquires Argina Technics

Gimv acquired a majority stake in Dutch group Brakel in September 2015

Gimv in talks to sell Lampiris to Total

Gimv invested €40m in Lampiris via its Gimv XL buyout fund alongside SRIW in 2013

3i reaps £89m in Basic-Fit IPO

3i invested €97m in the company in 2013 through an MBO valuing it at €275m

Karmijn acquires art lessor Kunst.nl

Kunst.nl is the first investment made via Karmijn's second fund, Karmijn Kapitaal II

Karmijn Kapitaal closes second fund on €90m hard-cap

GP's first fund, Karmijn Kapitaal I, was launched in 2011 and has been fully invested

Vendis Capital acquires Noppies

Vendis made the acquisition via its second fund Vendis II, which recently closed on its €180m hard-cap

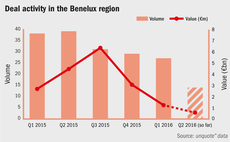

Usual suspects working hard in sedate Benelux market

Trend of declining dealflow in the region shows little signs of change, though buyout multiples return towards lower long-term averages

Safinco takes 24% stake in Gimv's Vandermoortele

Family shareholders will regain full ownership of the business following the transaction

Vendis closes Vendis II fund on €180m hard-cap

Second buyout fund, launched in 2015, closes ahead of its €150m target

Pamplona-backed Beacon acquires Ascendos

Portfolio build-up will enable Beacon Rail Leasing to expand its fleet of locomotives

Bencis Capital acquires majority stake in BRB

Buyout is financed via Bencis's fourth buyout fund, the €408m Bencis Buyout Fund IV vehicle

Gimv acquires 40% stake in Joolz

Investment firm invests alongside the company's managing director and founder

Avantium raises €20m in round led by PMV

The funds will be used to commercialise Avantium's bio-based packaging material

BlackFin promotes Sabine Mathis to partner

Mathis is currently BlackFin's CFO, having joined the GP in 2011 from Natixis

EQT appoints new director in Netherlands

Arjan Snijders will work within the Amsterdam-based mid-market investment strategy team