BPI France

BPI France et al. invest €100m in Kinéis

BNP Paribas Développement, shareholders and corporates also invest in the satellite operator

BPI France to hold first close for Silverlake fund - reports

The fund, which has a target of more than €10bn, will be backed by third-party money

Temasek leads $139m round for ManoMano

With the new funding round, the company plans to recruit 200 people in Barcelona and Bordeaux

Goldman Sachs, BPI France et al. back $70m round for LumApps

Latest fundraise for the France-based SaaS provider follows a $24m series-B in Q3 2019

PE-backed Sulo acquires San Sac from Accent

Accent Equity Partners initiated the sale for the waste containerisation company in October 2018

Consortium invests $30m in series-B round for Eyevensys

Company will use the funds to develop its treatment of chronic non-infectious uveitis

Versant Ventures et al. back VectivBio

The $35m investment will be used to launch the biotech company following its spin-out from Therachon

Siparex, I&F et al. back Rondot SBO

GP Siparex first invested in the glass manufacturing equipment specialist in 2016

FrenchFood Capital backs Class'croute SBO

French food-focused GP invests via its €132m maiden fund, closed in Q3

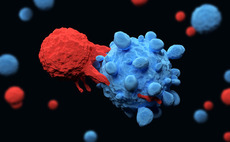

VC-backed ImCheck Therapeutics raises $53m series-B

Round is co-led by BPI France and Pfizer Ventures, the venture capital arm of pharmaceutical giant Pfizer

Consortium backs €38.75m series-B for Tissium

France-based wound dressing developer previously raised €30.5m at the series-A stage

PE-backed Groupe Blondel buys Transports Regis Martelet

Historical backers Picardie, BPI France and CM-CIC reinvest in the logistics company business

PE-backed Addev Materials bolts on US businesses

Tikehau and BPI France inject €33m into Addev Materials Group to sponsor the US bolt-ons

BPI France, Carvest back Toutenkamion

President Girerd will remain the majority shareholder of France-based Toutenkamion

PE-backed Verallia floats with €3.2bn market cap

Verallia, having set a €26.50-29.50 indicative range, has listed at €27 per share

Apollo- and BPI France-backed Verallia sets IPO price range

BWSA, a Brazilian investment company, commits to place an order to the tune of €275m

Amundi, BPI France, Socadif invest €115m in Wifirst

GPs carve out France-based Wifirst, an internet access provider, from the Bolloré Group

Siparex et al. acquire Sintex NP for €155m

Deal for the plastics firm forms part of the trade vendor's plans to focus on its domestic market

GPs sell MeilleursAgents to trade in €200m deal

Axel Springer's Aviv buys France-based MeilleursAgents, an online real estate service

Tikehau, BPI France back Groupe Rougnon SBO

Tikehau invests in the French environmental engineering firm via its T2 Energy Transition Fund

LSP et al. in €67m series-A for Alizé Pharma 3

LSP leads the round for the biotech business, investing alongside previous and new backers

BPI, Supernova in €20m series-C for logistics business Traxens

Company intends to use the fresh capital to expand internationally, with a special focus on Asia

CM-CIC Investissement, BPI France back Alpina Savoie

GPs invest in France-based Alpina Savoie, a pasta, semolina and couscous producer

Idinvest, BPI France back Ornikar €35m series-B round

Former investor Idinvest and newcomer BPI France back Ornikar, an online driving school