Carlyle Group

unquote" data snapshot: the five biggest buyouts of 2016

The year’s two largest deals, somewhat unusually, took place in Italy and Poland

unquote" LP and secondaries round-up

US and European LPs bring PE investments in-house in our latest round-up of LP and secondaries news

KKR, Advent, Apollo et al. endorse ILPA's reporting template

Insitutional Limited Partners Association receives support from major GPs for standardised reporting

Carlyle holds final close on $3.6bn for long-term fund

Fund has already deployed $1.1bn in four businesses, aiming for longer holding periods

Carlyle's Cap Vert Finance acquires Nexeya Services

Carlyle became majority shareholder in the group in 2015

Private equity's public market problems

Despite strong investor appetite for listed private equity houses, life on the public markets brings with it numerous challenges

Carlyle to buy Atotech from Total for $3.2bn

GP will draw down capital from its vehicles Carlyle Europe Partners IV and Carlyle Partners VI

Charterhouse buys Sagemcom from Carlyle

Tertiary buyout sees the Carlyle Group selling the business after five years at the helm

Carlyle-backed Homair acquires European Camping Group

Carlyle acquired a majority stake in the group in 2014, taking over from Montefiore

The call of Africa: Exit focus

Comparatively longer holding periods and sales to PE buyers or strategic investors characterise the continent's current exit market

Carlyle's Comdata buys Turkish peer Win Bilgi Iletisim

Deal follows the recent bolt-on acquisition of Spanish competitor Digitex in February 2016

Carlyle buys minority stake in Schön clinic group

Deal values Schön Klinik, which has 17 locations across Germany, at €1.5bn

Carlyle's Addison Lee acquires Octopus-backed Tristar

Post-transaction, the combined executive car hire company will have a headcount of 800

Carlyle acquires packaging producer Logoplaste

Deal marks the seventh transaction for the firm’s €3.75bn 2013-vintage vehicle, Carlyle Europe Partners IV

Carlyle takes 95% stake in Cupa for €170m

Following press reports, fresh capital will be used to repay the company’s €155m net debt

Carlyle sells remaining 13.9% Applus stake for €150m

GP has fully exited the business after a nine-year holding period

IK in €300-350m deal to acquire Marle from Carlyle

IK is acquiring Marle through its buyout fund IK VII, closed on €1.4bn in October 2013

Carlyle Cardinal invests in Learning Pool

Deal marks the first investment for Carlyle Cardinal in Northern Ireland

Carlyle sells 10% of Applus for €111m

Carlyle-backed Azul has reduced its stake in the business to 13.97%

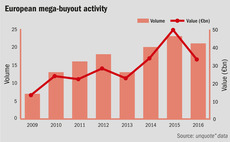

How private equity is dealing with the debt deluge

Despite jitters in the large-cap space, the European mid-market continues to be flooded with financing options

The perfect LP base: Diversification or concentration?

Part one of our LP selection series assesses how diversified an LP base should be, and why

Carlyle Group acquires Spain's Digitex in SBO

Deal marks an exit for Altra Investment after a five-year holding period

Deal in Focus: Aksia launches Italian call centre platform

A look back on Aksia's dual acquisition of Italian call centre operators Contacta and Visiant

Deal in Focus: PAI checks in to B&B Hotels in €825m SBO

An in-depth look at Carlyle and Montefiore's sale of B&B Hotels to PAI Partners for €825m