Cinven

Cinven backed Synlab raises €250m via capital increase

Cinven will remain the majority shareholder of Synlab and other LP will retain its current stake

Deal in Focus: Bain and Cinven to take Stada private

Acquisition of German pharmaceutical company would be the largest buyout ever recorded in the country

Bain and Cinven to take Stada private

Offer of €66 per share values the German pharmaceutical company at €5.3bn EV

Cinven and Permira sell 10.2% of JRP for £124m

Partial divestment of the listed financial services company comes 17 months after the group was formed

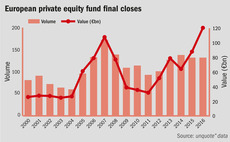

European fundraising surpasses pre-crisis high

Funds investing in Europe raised €120bn in 2016, up 37% on the year before

Stada tells PE bidders to improve offers

German drug manufacturer reportedly received offers from Bain/Cinven and Advent/Permira consortiums

Cinven's CeramTec acquires UK Electro-Ceramics from Morgan

ТЃ47m deal for the technical ceramics business marks the second bolt-on for CeramTec under the GP's tenure

Cinven promotes three to partner

Promotions of Europe-based team members come six months after the GP closed its sixth fund

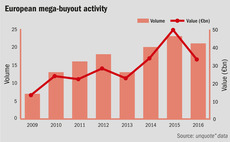

unquote" data snapshot: largest buyout fundraises of 2016

Though the number of €1bn+ funds to hold final closes fell in 2016, a number of large-cap players remained active on the fundraising front

unquote" data snapshot: the five biggest buyouts of 2016

The year’s two largest deals, somewhat unusually, took place in Italy and Poland

Cinven sells HEG to GoDaddy in €1.69bn deal

Deal sees тЌ605m returned to vendors and values web services provider at 11x its 2016 EBITDA

Ardian buys SLV from Cinven for €800m

Cinven said the business generated a 40% increase in turnover since its acquisition in 2011

Deal in Focus: Cinven sells Avio to Space2

GP divests Italian aerospace operator to trade buyer following decade-long tenure

Cinven fully exits aerospace operator Avio

GP has fully exited its portfolio company after a 10-year holding period

Cinven, Permira and Mid Europa in $3.25bn Allegro buyout

Deal marks one of the largest transactions in the CEE region since the global financial crisis

Cinven and CVC acquire NewDay in £1bn deal

Deal sees the credit card company abandon plans for an IPO

Cinven's Camaïeu in €500m debt restructuring

Womenswear company's anticipated EBITDA has decreased by almost a third year-on-year

HgCapital-backed Visma sells BPO unit to HgCapital

HgCapital carves out business process outsourcing division from KKR-, HgCapital- and Cinven-owned parent

Cinven's Ergo buys Old Mutual Wealth Italy for €278m

Deal follows the GP’s expansion plan for its portfolio company Ergo Italia

Cinven's sixth buyout fund holds final close on €7bn

Vehicle will make тЌ150-600m investments across Europe, the US and Asia

Cinven's Synlab completes €190m refinancing

Laboratory analysis company will repay capital drawn from its revolving credit facility

Cinven buys Hotelbeds for €1.2bn

Backers include Canada Pension Plan Investment Board and the management team

Deal in Focus: Advent unlocks Spain's troubled housing market

An in-depth look at Advent’s €350m exit of Tinsa in the difficult Spanish property market

Cinven in final Numericable exit, reaps 4.7x multiple

European private equity firm Cinven has fully realised its investment in Numericable by selling its remaining shares in media and telecoms business Altice, Numericable’s listed parent.