EQT

EQT acquires cyber security business Utimaco in SBO

Sellers reinvest part of their proceeds for a minority stake as part of the deal

EQT closes first US fund short of $1bn target

Nordic-based GP holds final close on $726m for mid-market buyouts in US

Nordic take-privates: Why speed is of the essence

Two out of four private-equity-led Nordic de-listings since 2015 have been targeted by third parties aiming to cash in

EQT and Accent in SEK 1bn Scandic share sale

GPsт joint holding vehicle sells 15.6 million shares in accelerated bookbuilding worth SEK 1.08bn

EQT invests in TransIP

Transaction marks EQT Mid Market Europe's first investment in the Benelux region

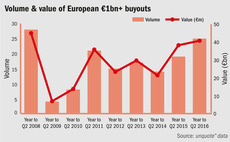

Southern Europe leads renaissance of billion-euro club

Dealflow in the тЌ1bn+ buyout segment reached an eight-year high across Europe in the 12 months to Q2 2016

EQT sells TitanX to Tata

Exit is the second sale from the 2005-vintage EQT Opportunity fund to happen in 2016

EQT Equity completes first US investment with Press Ganey takeover

Nordic PE firm taps its EQT VII vehicle despite having a dedicated US fund

Berlin keeps Germany afloat

The German capital has emerged as the lone bright spot in the country, buoying the German private equity industry

EQT in SEK 410m trade sale of Granngården

Home improvement retailer was acquired through EQT Opportunity Fund in 2008

EQT sells Spanish parking operator Parkia

EQT Infrastructure and Mutua Madrileña sold the business after a five-year holding period

Lack of Nordic exits a sign of weak portfolios, says Altor's Mix

Conditions in the Nordic markets could hardly be better for private equity exits, Harald Mix said at a conference

EQT floats AcadeMedia in SEK 3.7bn IPO

Private education companyтs shares surged during the first hours of trading despite a controversial reputation

Reputational risk continues to haunt Swedish private equity

Increasing attention from the media, regulator and politicians means Swedish firms must invest responsibly and highlight their growth credentials

EQT buys Bilfinger's real estate service for €1.4bn

EQT paid partly in cash and partly via a deferred fixed-interest facility

EQT in €830m Atos Medical exit to PAI

PAI Partners becomes the third private equity owner of Atos, following EQT and Nordic Capital

EQT holds €566m final close on first venture fund

Stage-agnostic European venture fund had been rumoured for a year prior to announcement

Nordic PE must focus on reputation and responsibility, says EQT's von Koch

EQT managing partner Thomas von Koch spoke as keynote at todayтs unquote" Nordic Private Equity Forum in Stockholm

PE and the 4th Industrial Revolution: The new deal

Part three: is private equity waking up to the realities of investing in companies at the forefront of the Fourth Industrial Revolution?

PE and the 4th Industrial Revolution: Seizing the initiative

Part two: private equity players must embrace the Fourth Industrial Revolution and identify when challenges can be turned into opportunities

PE and the 4th Industrial Revolution: Proceed with caution

Part one: technological advances are at the forefront of the so-called Fourth Industrial Revolution, but what are the implications for private equity?

Private equity and the 4th Industrial Revolution

Digitalisation and technological advances are at the forefront of the so-called Fourth Industrial Revolution, but what are the implications for PE?

EQT appoints new director in Netherlands

Arjan Snijders will work within the Amsterdam-based mid-market investment strategy team

EQT closes mid-market credit fund on €530m

Close exceeds the €500m target and marks the latest addition to the GP’s credit division