Exclusive

France: Private debt still thriving despite muted fundraising

Current fundraising pipeline and recent investment statistics suggest the French private debt space is still in rude health

GVC Gaesco launches €50m growth capital fund

Fund acquires minority stakes in family-owned Spanish companies operating in a variety of sectors

Italian GPs embrace asset-class diversification

Local players have launched new strategies and vehicles dedicated to private debt, special situations, credit recovery and non-performing loans

DevCo Partners raises €180m for next platform deal

Firm launched its latest vehicle before the summer and sought to attract a broader base of investors

Idinvest passes €500m mark in Private Debt V fundraise

Fund, which has already been invested in at least one transaction, has a €1bn target

Innogest to launch trio of €100m VC funds

Healthcare and digital tech vehicles will each target 12-15 companies with €10m tickets

Ver Capital launches €300m debt fund

Firm is also launching two more vehicles: Ver Capital Short Term Fund and Ver Capital Partners VIII

Sovereign's Peter Shaw joins Inflexion

Inflexion has added 11 professionals to its investment team since March this year

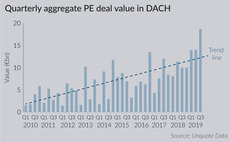

DACH activity skyrockets in Q3 despite looming recession

Aggregate value in DACH for Q3 reached its second highest level at €18.7bn

Itago launches €130m buyout fund

Itago is an Italian GP recently established by a team that span out from Finint & Partners

Balderton VII closes on $400m hard-cap

Balderton VII's predecessor closed on $375m and is now more than 50% deployed over 30 investments

Xenon closes seventh buyout fund on €300m

Vehicle is larger than its predecessor, Xenon Private Equity VI, a €184m fund closed in July 2014

Essling holds first close on €90m for Co-invest 3

Fund backs lower-mid-market to large-cap businesses based in Europe and the US

Team spirit: the enduring appeal of co-investment

This year, тЌ7.87bn was collected across seven co-investments funds, breaking Unquote Data records

Acton Capital Partners closes fifth fund on $215m

Firm has made six investments from the fund so far, with two more in the pipeline

Q3 Barometer: deal volume hits new record with mid-market push

Buyout market has been strengthening consistently and was only four deals away from hitting 300 in the third quarter

F2i, Hat sell stakes in Sia to CDP Equity in €3.2bn deal

Deal ends a five-year holding period for F2i and Hat, which owned 17% and 8.6% respectively

Entangled Capital launches €150m buyout fund

Fund is dedicated to Italian small and mid-market companies operating in the industrial sector

B & Capital holds final close for maiden fund on €217m

PE firm is sponsored by consultancy Roland Berger and surpasses its €200m target

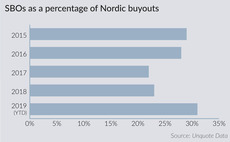

"Pass-the-parcel" deals surge in Nordic region as PE matures

At nearly a third of all buyouts, the proportion of SBOs is now higher in the Nordic region than it is across Europe as a whole

Frog holds first close for Frog European Growth II

Frog Capital has closed its second European Growth fund on more than a third of its тЌ150m target

Breega holds €90m first close for Breega III

French early-stage VC launched the fund in Q3 and expects to hold a final close in H1 2020

UK General Election: reactions from the PE community

Private equity players and advisers speak on the potential for the resolution of Brexit and the effect it may have on deal activity

ILPA mulling Europe-focused legal document Model LPA

Model LPA is designed to reduce complexity, cost and resources required when negotiating fund terms