Germany

HTGF et al in series-B for Customer Alliance

High-Tech Gründerfonds (HTGF), Mountain Super Angel, K5 Ventures and netSTART Venture have invested in a second round for Berlin-based software-as-a-service provider Customer Alliance.

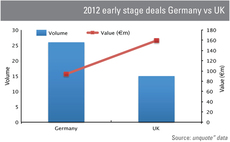

Early-stage investments: German deal volume booms

While German early-stage activity has risen in volume in the first half of 2012, the UK holds its own with strong overall deal value.

Equistone takes majority stake in Vivonio

Equistone Partners Europe has taken a 67% stake in German furniture maker Vivonio Furniture Group, a newco formed by combining Orlando Management-backed MAJA, Staud and SCIAE.

Evonik invests in Pangaea Ventures fund

CVC-backed German speciality chemicals maker Evonik has invested in Pangaea Ventures Fund III through its recently established venture unit.

Equita CoVest in €115m first close

Equita Management has held a €115m first close for its Equita CoVest fund.

T-Venture backs DropGifts

T-Venture has backed Berlin-based social gifts start-up DropGifts with a seven-digit-euro investment.

Perusa buys TLT Group

Perusa has wholy acquired German automotive logistics business Trans-Logo-Tech Group (TLT) via its €207m Perusa Partners Fund II.

Moody's cuts German credit outlook

Moody's has indicated it may downgrade Germany's Aaa credit rating, which could make financing operations in Germany more difficult.

AXA PE buys Schustermann & Borenstein

AXA Private Equity has bought German fashion exporter Schustermann & Borenstein in an MBO that reportedly values the company at $370m.

Index et al. partially exit Funxional Therapeutics

Index Ventures, Novo A/S and Ventech have partially exited their investment in Funxional Therapeutics, following the companyтs sale of its rights to lead anti-inflammatory drug FX 125L to German pharmaceuticals company Boehringer Ingelheim.

Former Metro boss launches PE house in Germany

Former Riverside partners Kai Köppen and Volker Schmidt have partnered with ex Metro boss Eckhard Cordes and former Apax partner Christian Näther to form a new buyout house in Munich, local reports suggest.

Renewed confidence in alternative energy

Alternative energy

Sun-backed Neckermann files for insolvency

Sun European Partners' German mail-order portfolio company Neckermann has filed for insolvency following unsuccessful talks with the PE firm.

HTGF et al. invest €1m in Data Virtuality

High-Tech Gründerfonds (HTGF) and Technologiegründerfonds Sachsen (TGFS) have invested €1m in German software start-up Data Virtuality.

HPE Holland backs Cotesa with €20m

HPE Holland Private Equity has invested €20m in German fibre-reinforced composites manufacturer Cotesa.

RiverRock closes European SME fund on €169m

RiverRock European Capital Partners has announced the final close of its European Opportunities Fund on тЌ169m.

Capvis and Partners Group sell Bartec to Charterhouse

Capvis Equity Partners and Partners Group have sold their majority stake in German industrial safety technology provider Bartec to Charterhouse Capital Partners.

Cipio et al. back wywy with €2.5m investment

Cipio Partners, business angel Tobias Schmidt and other investors have provided German second-screen service provider wywy with €2.5m of venture capital.

BV Capital rebrands as e.ventures

Global venture firm BV Capital has combined its five local funds into a unified international entity named e.ventures.

Nauta leads €13.5m round for Mysportgroup

Nauta Capital has injected €3.5m into German e-commerce platform Mysportgroup as part of a €13.5m funding round.

Equistone acquires EuroAvionics

Equistone Partners Europe has acquired EuroAvionics Holding, a manufacturer of civil certified systems for the aviation industry, from Varde Investments Ireland.

Doughty Hanson-backed Vue to take over CinemaxX

Doughty Hanson’s portfolio company Vue has announced its intention to launch a voluntary public takeover offer for German multiplex chain CinemaxX.

KKR acquires WMF shares from Capvis

Kohlberg Kravis Roberts (KKR) has bought a 37% capital stake in German cutlery and coffee machines maker Württembergische Metallwarenfabrik (WMF) from Capvis Equity Partners-managed Crystal Capital for €238m.

HTGF et al. back in Epivios

High-Tech Gründerfonds (HTGF) and the investment arm of Life Science Inkubator have invested in German epigenetics specialist Epivios, alongside Technology Transfer Heinrich Heine University and a private investor.