Germany

Finatem acquires WST

Finatem Beteiligungsgesellschaft has acquired a majority stake in WST Präzisionstechnik, a specialised manufacturer of precision parts, as part of an MBO from the company's private owners.

Terra Firma to refinance Deutsche Annington

Terra Firma has started negotiations with bondholders to recapitalise German real estate fund Deutsche Annington Immobilien GmbH, including a €500m equity injection, according to reports.

Providence acquires HSE24 from AXA PE

Providence Equity has acquired Germany-based international home shopping group Home Shopping Europe (HSE24) from AXA Private Equity for an estimated €650m.

Palero Capital acquires Tesa Bandfix

Luxembourg-based GP Palero Invest has acquired Switzerland-based Tesa Bandfix from its German parent Tesa SE in an all-equity transaction.

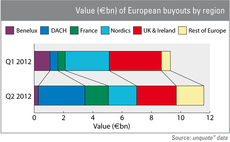

DACH buyout market outweighs neighbours in Q2

Buyouts in the German-speaking region have shown a significant gain in value from the first to the second quarter of 2012, enabling the region to top the regional aggregate value table.

BC Partners sells stake in Brenntag for €577.5m

BC Partners and co-investors have sold seven million shares in listed German chemicals company Brenntag, reducing their joint stake to 13.6%.

ECM closes fourth fund on €230m

ECM Equity Capital Management has announced the final close of its fourth fund, GEP IV, on €230m.

Acton leads financing round for Fashion For Home

Acton Capital has led a funding round for German online furniture retailer Fashion For Home.

Target Partners leads series-A for Theva

Munich firm Target Partners is understood to have led a seven-figure series-A round in BayBG-backed German energy technology company Theva Dünnschichttechnik.

Earlybird et al. invest $4m in Traxpay

Earlybird Venture Capital has invested around $3.2m in German-American B2B payments service provider Traxpay as part of a $4m series-A round together with three business angels and a strategic investor.

Mobility Ventures announces new managing partner

Lothar Pauly, former CEO of Siemens Communications has joined Mobility Ventures as managing-partner Europe.

Blackstone exits Klöckner Pentaplast

Blackstone has sold its majority stake in German thermoform packaging company Klöckner Pentaplast to Strategic Value Partners.

Intel Capital et al. back KupiVIP

Intel Capital has led a $38m funding round for Russian e-commerce fashion retailer KupiVIP Holding.

Evonik cancels IPO

CVC-backed German chemicals maker Evonik has announced the cancellation of its planned IPO.

DACH unquote" June 2012

Vienna’s stock exchange has experienced a few tough years, but new chief executive and several planned private equity IPOs over the next two years could see the bourse becoming attractive to private equity once again.

Wellington Partners et al. invest in Readmill

Wellington Partners has joined previous investors Passion Capital and Index Ventures in a series-A funding round for German social reading platform Readmill.

H2-backed Smartwares buys Hanesbrands Europe

Consumer essentials retailer Smartwares, a portfolio company of H2 Equity Partners, has wholly acquired Hanesbrands Europe as part of its buy-and-build strategy.

HTGF leads seed round for KeyRocket

High-Tech Gründerfonds (HTGF) has led a seed funding round for keyboard shortcut trainer KeyRocket, the launch product of start-up business Veodin Software.

Market volatility threatens Evonik IPO

The RAG Foundation, which owns a majority stake in CVC-backed German chemicals maker Evonik, could cancel the company's IPO in light of the current market environment.

Capvis buys hessnatur

Swiss private equity firm Capvis Equity Partners has acquired German clothing company hessnatur in a management buyout from Primondo Specialty Group for an estimated €30-40m.

Target Partners invests in adeven

Munich-based venture capital firm Target Partners has invested between €1-10m in a series-A funding round for mobile advertising analyst adeven.

CVC-backed Evonik announces IPO

CVC Capital Partners-backed German chemicals maker, Evonik Industries, has confirmed plans to float in the Prime Standard segment of the Frankfurt stock exchange.

DACH unquote" May 2012

Germany has recently reformed its insolvency law with the introduction of ESUG, the Act for Further Facilitation of the Reorganisation of Enterprises, which promises to make it easier for businesses to get out of administration and back on their feet....

LinkedIn co-founder joins Earlybird

LinkedIn co-founder Konstantin Guericke has joined German technology venture capital firm Earlybird as a partner.