Germany

Bid acquires Pisa Sales

Bid is expected to merge Pisa with portfolio company Infopark, which it acquired in August 2020

Vangionen Capital backs Guenter Hofstetter

Vangionen is acquiring the company following its filing for bankruptcy at a court in Heilbronn in June

Waterland's Beck Et Al buys InfoWan

IT cloud service group now comprises four businesses and was formed by Waterland in May 2020

Adiuva-backed Konzmann acquires Trenker

Building services provider has made 12 add-ons since Adiuva Capital first invested in 2016

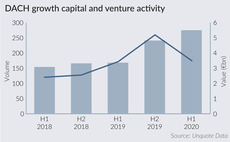

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

Deutsche Beteiligungs AG acquires Multimon

Acquisition of the fire safety systems provider is the first from the GP's €1.1bn eighth fund

Advent buys 30% stake in Aareon

Deal gives the property software company an EV of €960m, with Advent's stake valued at €260m

Debt funds making inroads in DACH amid Covid-19, says GCA

GCA's Mid Cap Monitor shows that debt funds financed 71% of German LBOs in H1 2020, with the firm expecting an activity uptick in Q4

VCs in €5m round for Klima

EVentures, 468 Capital and HV Holtzbrinck back the round for the climate change mitigation app

La Famiglia announces second fund

B2B-focused venture capital fund has made eight investments so far and is targeting €50m

Unquote Private Equity Podcast: Made in Germany

This week, the Unquote Podcast focuses on Germany, where private equity activity has remained resilient despite Covid-19

HQ Equita buys majority stake in Muegge

Microwave components producer was acquired from its parent company Meyer Burger Technology

Advent International acquires stakes in Hermes UK and Germany

GP reportedly pays тЌ1bn for the two stakes in the parcel delivery firm

Bid Equity buys majority stake in Infopark

Deal is the second from Bid Equity II, which held a close in November 2019 and targets B2B software

DvH Ventures launches Digital Health Fund

Dieter von Holtzbrinck Ventures (DvH Ventures) has announced the launch of its first Digital Health fund, which has held a first close on €60m.

Rigeto Unternehmerkapital acquires Oehm & Rehbein

Acquisition of Germany-based x-ray equipment and software was backed by senior debt from ApoBank

Triton's All4Labels buys GPS Label, Rotomet

Following the acquisition, GPS-Rotomet will operate under All4Labels, which Triton acquired in 2019

EMZ Partners invests in Ankerkraut

Founding Lemcke family will retain a majority stake in the Germany-based spice retailer

DBAG reports NAV increase in Q2 2020

GP's quarterly results also state that the investment period for DBAG VIII began in August 2020

Nordic Alpha Partners et al. in $14m round for DyeMansion

Series-B round follows a seed round in 2018, backed by BtoV, AM Ventures and Unternehmertum

Versant and RA lead €66m round for T-knife

Andera Partners and Boehringer Ingelheim Venture Fund also backed the T-cell therapy developer

Marcol invests in Fernarzt, launches new HealthHero platform

Seed investor Heartbeat Labs will retain a 10% stake in Fernarzt

Raymond James expands German industrial technology team

Firm announced the promotion of Sherif Abdel-Aziz, while Tobias Ramminger joins from Lincoln

Callista buys Ledvance Eichstätt

Company will now operate as Aurora Lichtwerke and was sold as part of a non-core asset divestment