Germany

Steadfast buys Stanz- und Lasertechnik Jessen

Steadfast leveraged the transaction at 3.5x EBITDA and invested via its third €104m fund

Steadfast in Guntermann & Drunck MBO

Steadfast emerged successful in the owner's second attempt to sell the company

Global Founders leads €1.7m round for Buying Show

Fresh capital will be used to improve the platform's technology and expand the company's trader network

IBB and Axel Springer invest in Blogfoster

Startup aims to expand its customer base and grow its team from 20 to 35 people

VR Equitypartner backs Dr Förster

New owners plan to improve the company's e-commerce activities and hire more staff

MenschDanke buys VC-backed Versus

Earlybird, 500 Startups and other investors exit after a three-year period

HTGF, MBG invest in CommSolid's seed round

Startup develops communications technology for Internet-of-Things devices

HTGF backs MicroDimensions

HTGF and Bayern Kapital recommit after backing the company's seed round in 2011

Berlin keeps Germany afloat

The German capital has emerged as the lone bright spot in the country, buoying the German private equity industry

Project A backs Store2be

Project A invested alongside Global Founders Capital and business angels

Afinum's Empolis invests in Smart Reporting

Empolis financed the minority-stake acquisition of Smart Reporting with its own cash flow

Gilde buys Losberger from HIG

HIG’s exit comes five years after the GP acquired the German tent and hall maker in an MBO

Exporo raises €8.2m from EVentures et al.

Fresh capital will go toward the expansion of staff and marketing efforts

Motu et al. back Parlamind with €1.5m seed funding

Startup aims to take its product's current beta version to market

First funding round for CheckMyBus

Startup hopes to benefit from rising online sales for inter-city bus tickets

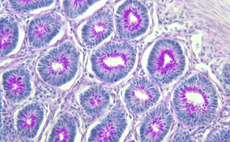

Apax buys pharma business Neuraxpharm

Acquisition is part of Apax's plan to consolidate the European generic medicines market

Advent sells final Douglas asset Thalia

Business is believed to have been sold for in the region of €100-500m

Quantum buys train maintenance firm Bahnwerk Eberswalde

Turnaround strategy includes portfolio synergies and reduced staff numbers

Creathor backs CryoTherapeutics' €5.2m round

Fresh funding will be used for a clinical trial and to secure market approval

TCV invests €45m in eyewear site Brillen.de

Brillen.de claims the size of its market is expected to reach €30bn by 2017

HQ Capital closes seventh Auda fund on $375m

Seventh vehicle from the Auda series closes above its $350m target

EQT Ventures leads $10m round for Service Partner One

Fresh capital will enable the company's expansion to more European cities

I&F-backed Claire-Sainte-Lizaigne acquires Fast

Industries & Finances Partenaires acquired the group as a Veolia spinout in 2012

Target et al. back Finanzchef24's €4m round

Existing investors HW Capital and Mercura Capital recommitted in the new round