Gilde Investment Management

Gilde Healthcare closes fourth buyout fund on EUR 517m

Double the size of its predecessor, the new vehicle was oversubscribed and saw nearly all Gildeтs existing LPs investing

Novo, Sanofi lead $83m round for Lava Therapeutics

Corporate venture firms were joined by new and existing investors, including Gilde Healthcare

Gilde Healthcare V close on $450m hard-cap

Legal advice was provided by a team from Jones Day led by partner Quirine Eenhorst

Mentha buys and merges Paradigma and BlijWerkt

Gilde Healthcare was invested in HR specialist BlijWerkt since 2011

Gilde Healthcare closes third fund on €200m

Gilde Healthcare Services III targets healthcare providers based in the Benelux and DACH regions

LSP leads $28m round for Lumeon

Healthcare software company will expand its US operations and invest in marketing

Gilde Healthcare sells NightBalance to Royal Philips

Philips expands its sleep and respiratory care portfolio through the acquisition

Gilde Healthcare exits Stat-DX

Gilde Healthcare led a €31m funding round for molecular diagnostic specialist Stat-DX in 2016

Gilde Equity Management buys conTeyor in SBO

GP takes over from Down2Earth in backing the Belgian recycling and packaging business

Gilde Healthcare's Rad-X buys TelradKo

Acquisition will provide TelradKo with fresh capital to accelerate its expansion

Agic, Capvis, Gilde, Nordic Capital in final Amann Girrbach round

Nordic Capital is reportedly the front-runner in the sale of the Austrian dental prosthetics company

Private debt funds expand market share in Germany

Growing use of use of first-out, second-out unitranche leads to private debt funds more than doubling their share of German mid-market deals

Gilde sells Synbra to trade for €117.5m

Sale ends an 18-year holding period for Gilde, which acquired the company in 1999

Gilde Healthcare-backed Rad-x buys SMII

Gilde Healthcare began its buy-and-build strategy in this sector in January 2017

Gilde acquires Performation in MBO

GP acquires a majority stake in the Dutch healthcare business-intelligence provider

Gilde sells Viroclinics to Parcom Capital

Gilde sells the Dutch contract research organisation after a four-year holding period

PE-backed Rad-x bolts on Acura

Deal marks the second bolt-on for the business, following the acquisition of Swiss diagnostic imaging provider IRD

Gilde Buy Out Partners sells HG International to Cobepa

GP had taken over the group from sister firm Gilde Equity Management in 2013

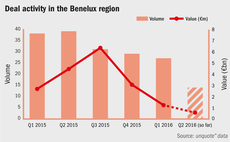

Usual suspects working hard in sedate Benelux market

Trend of declining dealflow in the region shows little signs of change, though buyout multiples return towards lower long-term averages

Gilde leads €25m series-C for Stat-Diagnostica

Backers include Kurma Partners, Ysios Capital, Idinvest Partners, Caixa Capital Risc and others

VC-backed Acacia to list in October

Offering size understood to lie around the ТЃ150m mark

VC-backed Ascendis raises $108m in IPO

Listing priced at $18 per share

Fund in focus: Gilde Healthcare closes GHS II on €100m

Managing partner Jasper van Gorp shares details with unquote"

Ascendis completes $60m series-D

A total of seven investors comitted capital to the round