Partners Group

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

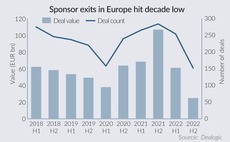

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

Rovensa tipped for sale as PE owners weigh exit options

Bridgepoint and Partners Group have yet to decide on a process for the Portugese agriculture business

Civica owner Partners Group begins sponsor discussions for post-summer exit

GP previously attemped to sell the UK-based software firm in 2021, with the process stalling over valuation disagreements

BC's VetPartners sees Blackstone, KKR, Partners Group among parties preparing bids

Veterinary group could fetch a valuation in the GBP 2.5bn-GBP 3bn region, having been acquired by BC in 2018

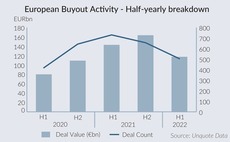

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

Partners Group sets fundraising guidance at USD 17bn-22bn

Private markets investor finished 2022 at the bottom of USD 22bn-26bn target for new commitments

Bellevue hires ex-Partners Group trio for new secondaries strategy

Switzerland-based asset manager plans to launch first secondaries vehicle in 2023

DBAG exits Cloudflight in sale to Partners; reaps over 4x money

Deal values Germany-based digital transformation company at just under EUR 400m

H2 Equity's Optegra sale advances to second round

UK-based ophthalmology business has received NBOs implying an EBITDA multiple of more than 15x

Partners Group hires ZF's Scheider as head of private equity

Car parts maker CEO will join the Swiss GP’s headquarters in Baar-Zug in early 2023

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Civica owner Partners Group expected to retry sale this year

Sponsor has kept an open mind about options for the IT services group after calling off a Goldman Sachs-led auction last summer

Volpi exits Version 1 to Partners Group

The Jefferies-led auction also saw Apax, OTTP, Cinven and Bain compete for the Irish IT solutions group

Equistone sells FirstPort to sponsor-backed Emeria

Deal for UK property management group marks first exit from Equistone Partners Europe Fund VI

Battery exits Forterro to Partners Group for EUR 1bn

New owner to expand London-based ERP provider with organic growth initiatives and acquisitions in adjacent geographies, sub-verticals

Partners Group set for second PG Life fund

PG Life II is expected to follow the global impact investing strategy of its predecessor

Partners Group secures minority stake in Breitling

CVC agreed to acquire an 80% stake in the then-family-owned Swiss watchmaker in early 2017

TA Associates takes minority stake in Foncia

TA secures a 25% stake, while Partners Group remains the controlling shareholder

Partners Group closes fourth PE programme on USD 15bn

Programme includes USD 6bn from the GP's fourth direct PE fund, Partners Group Direct Equity 2019

BC sells Pharmathen to Partners Group in EUR 1.6bn deal

BC Partners acquired the Greece-headquartered generic pharmaceuticals developer in 2015 for EUR 475m

Target Global leads $650m round for Wefox

Round is the largest ever raised in the European insurtech sector, according to Unquote Data

Omers buys into Partners Group's International Schools Partnership

Deal gives the international group of K-12 schools an enterprise value of тЌ1.9bn

EQT in exclusivity to acquire Cerba from Partners Group

Medical diagnostics business has previously been backed by sponsors including Astorg, IK and PAI