Principia

CDP Venture Capital leads €15m series-C for Wise

Indaco and Eureka also take part in the round, alongside previous backers including Principia and HTGF

Omnes, Principia, Seventure in €46.3m series-E for Enterome

New investors SymBiosis and Takeda Pharmaceutical Company also take part in the round

Principia backs laser specialist Lambda

Company management retains the remaining minority holding and stays on with the business

Principia sells Comecer to trade

ATS also acquires a majority stake from the Zanelli family for a total purchase price of €113m

Principia backs Gada

Company's management will retain the remaining minority holding and continue to lead the business

Principia invests €7m in Comftech

Company plans to use the fresh capital to launch its products on the European and US markets

Principia backs CrestOptics

VC firm deployed capital from its healthcare-dedicated vehicle Principia III – Health

Principia leads €10m series-A for CheckMab

GP deploys capital from its healthcare-dedicated vehicle Principia III to finance the investment

Principia et al. in €32m series-D round for Enterome

Company also nets a €40m credit line provided by the European Investment Bank

Vivocha sold to Aksía's Covisian

Deal sees Italian venture capital houses Principia and Vertis fully exit the business

Principia invests in Gemelli Clinical Trial Center

GP provides capital via its healthcare-dedicated fund, Principia III – Health

Principia launches fifth VC fund, Utopia

GP is also currently on the market raising funds for its fashion- and design-dedicated fourth vehicle

Principia backs Trifarma MBO

Deal is the first majority acquisition for the GP's healthcare-dedicated vehicle, Principia III Health

Principia leads €6.5m series-B for neurology firm Wise

Existing investors Atlante Ventures, High-Tech Gründerfonds, F3F and Antares join the round

Principia launches fashion- and design-focused VC fund

Launched with a €150m target, the fund expects to close its first transaction by Q3 2017

Invitalia and Principia lead €1.4m series-A for Pedius

Funding round backers include Invitalia Ventures, Pricipia and existing investor TIM Ventures

Principia buys 49% stake in Rigenerand for €8.7m

Deal marks the fourth transaction for the Principia III-Health venture capital vehicle

Principia invests €7m in Silk Biomaterials

Deal marks the third transaction of the biomedical- and healthcare-focused Principia III fund

Principia's Applix bolts on Melazeta

Third acquisition in five years for Applix, which will focus on digital entertainment

Principa divests Docebo to Klass

Investment will be used to support US expansion

Italian VC ecosystem shows signs of maturity

New laws aimed at start-ups as well as recent fund closes signal Italian VC is maturing

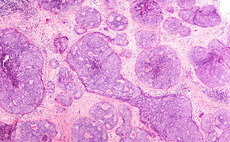

Sofinnova Partners et al. sell EOS for up to €310m

Sofinnova Partners, Aescap Venture and Principia have sold Milan-based cancer therapeutics firm Ethical Oncology Science (EOS) to Clovis Oncology via an agreement that could see the firm fetch up to €310m.

Principia backs Rysto with $1m

Italian venture capital firm Principia has injected $1m into Rysto, an online portal for jobseekers in hospitality and catering.

Principia backs Weekend-a-gogo

Italian VC player Principia has injected €450,000 into Neapolitan social tourism platform Weekend-a-gogo.