Top story

Mixed bag for Dutch retail market

As the Dutch economy strengthens, how have private equity investments in local retailers performed?

Nordic startup bloom may wither without government support

As Nordic cities continue to foster successful startups, should governments be doing more to improve affordability?

Deal in Focus: Advent unlocks Spain's troubled housing market

An in-depth look at Advent’s €350m exit of Tinsa in the difficult Spanish property market

Invoice discounting attracts growing private equity investment

As GPs become increasingly comfortable with alternative lending, those serving the small-cap market are gaining attention too

PE-backed IPO activity failed to ignite in Q1

Europe should see an uptick in IPOs throughout Q2 following one of the quietest first quarters on record, in terms of PE-backed flotations

Local capital may bridge gap between global LPs and Czech PE

With local LPs quietly upping their allocations to CEE funds, could we see the return of international LPs?

Golden age for debt funds in Germany?

Lighter rules for alternative lenders operating in Germany could encourage a wave of deal activity

Not covered: insurance, fraud and private equity liability

As GPs increasingly take out M&A insurance, can protection be offered against sellers acting maliciously?

Deal in Focus: Track record paramount in Altor's Infotheek deal

An in-depth look at Altor's acquisition of IT reseller Infotheek, marking its second Dutch deal

Value the individual: investing in people-led businesses

With an uptick in the number of people-led business investments, how does PE overcome the risks?

Consumer boom: the five largest Nordic consumer deals of 2015

The Nordic consumer sector was the only one to see measurable growth last year, in the face of an overall volume decline of nearly 20%

How private equity is dealing with the debt deluge

Despite jitters in the large-cap space, the European mid-market continues to be flooded with financing options

Comment: The shifting debt landscape

Christopher McLean of Grant Thornton discusses the impact of the changing debt market on private equity

Danske's Fromm discusses debt trends in the Nordics

Danske Bank's Lars Fromm says the Nordic market will be more balanced this year between IPOs and M&A

In Profile: Ufenau Capital Partners

A look under the bonnet of recently rebranded Ufenau, previously known as Constellation Capital

Startup boom: A wake-up call for Italian VCs

With a continued rise in the number of Italian startups, could local VCs be missing out?

Russian private equity vacuum remains

Despite a funding gap, private equity activity in Russia remains subdued

Strong valuations in Nordic region driving co-investments

With strong pricing in the Nordic countries, GPs are looking to co-invest in order to secure deals

Benelux: New investments slow down while large exits abound

New investments in the Benelux region have been subdued, but a number of large exits have bumped up Q1's figures

The birth of the French pension fund?

The French government’s plans to create a new pension funds regime could ultimately spell good news for private equity

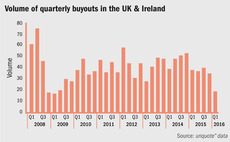

UK buyout activity suffers deepest decline since 2009

The volume of buyouts witnessed so far for the first quarter of 2016 is the lowest on record since 2009

Hidden gems: How German small-cap GPs source deals

While the German M&A market is known for high levels of intermediation, those in the small-cap space take a different approach

Deal in Focus: Trilantic's investment in Maugeri highlights structural healthcare reform

An in-depth look at Trilantic’s third investment in the Italian healthcare sector

SVCA chair Thand Ringqvist on global crises impacting Nordic PE

Elisabeth Thand Ringqvist discusses concerns for the Nordic PE industry, including the migrant crisis