Brexit puts the brakes on UK fundraising

Fundraising in the UK recorded its sharpest decline since the turn of the century in 2018, with anxiety around Brexit chief among investors' concerns. Gareth Morgan reports

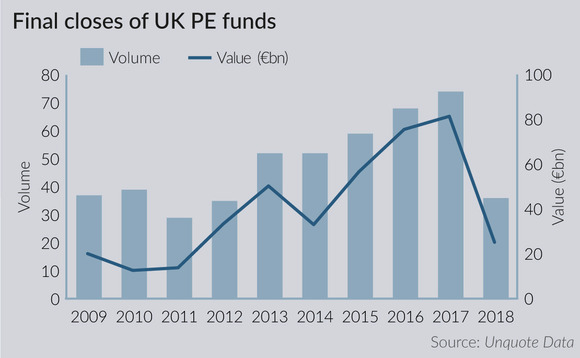

Private equity fundraising in the UK has seen a significant slowdown so far in 2018, with €25.2bn raised by 36 funds holding a final close by the end of Q3. This figure marks what looks to be the end of three consecutive years of growth in fundraising in the UK market, during which records for both the volume and value of funds raised annually were broken in each year.

The slowdown in the fundraising space is mirrored by a concurrent slowdown in buyouts, with €21.2bn in aggregate enterprise value across 166 deals logged by Unquote Data in the first three quarters of the year, down from 231 deals worth €41bn in 2017.

So far in 2018, the largest fund to hold a final close is BC European Capital X, which secured €7bn in January following the completion of a stapled secondary deal involving the GP's previous fund [Editor's note: BC Partners is the majority shareholder of Acuris, the parent company of Unquote]. There were only five other €1bn+ funds to hold a final close in 2018: TowerBrook V raised $4.25bn in June, Equistone VI closed on €2.8bn, Inflexion managed a £2.25bn double fundraise in May, and Alchemy Special Opportunities hit its £900m hard-cap in January.

This is in stark contrast to 2017, when 74 funds secured €81.4bn, including 17 €1bn+ offerings holding a final close. The total amount raised during the year, bolstered by these larger offerings, was a high-water mark for the private equity industry in the UK, breaking the records set for both the volume and value of funds raised the previous year.

Cooling off

With the largest percentage drop in terms of annual fundraising numbers since 2000, institutional investors appear to be turning their noses up at the opportunities UK private equity investments offer. "A slowdown in the UK in 2018 has definitely happened," says Angela Willetts, a managing director at Capital Dynamics. "This is in contrast to Europe, where the numbers are expected to be relatively robust." There are two main underlying causes of this slowdown: Brexit, and concerns about asset pricing across

western Europe.

Uncertainty around the UK's future trading relationship with the EU has been discussed ad nauseam since the Brexit referendum in 2016, although 2017's record fundraising and buyout numbers failed to reflect this lack of clarity. This year seems to have marked the point when this uncertainty has taken its toll on investor sentiment towards the UK. "There has been a noticeable impact [of Brexit] among some French and German LPs, and the withdrawal of the EIF will impact small-cap and mid-market fundraising," says Sunaina Sinha, managing partner at Cebile Capital.

Market participants tell of LPs freezing investment in the UK for the next six months as a consequence of this uncertainty, and also shifting sector focus away from consumer-targeted funds, which they anticipate will bear the brunt of the economic fallout of the UK leaving the EU. With a raft of UK high-street stores struggling over recent months, this decision looks to have been vindicated, at least in the short term.

As well as the economic issues weighing on investors' minds, there are additional concerns putting the brakes on investing in UK funds: "There's an element of exchange-rate risk entailed in backing sterling-denominated funds," says Willetts. "This is something our investment committee thinks about in detail, and is particularly the case for US-dollar investors."

A slowdown in the UK in 2018 has definitely happened. This is in contrast with Europe, where the numbers are expected to be relatively robust" – Angela Willetts, Capital Dynamics

Alongside political uncertainty, a second significant drag on fundraising has been continued elevated prices in the M&A space, in part a result of record fundraising leading to historically high levels of dry powder. "There is a capital asymmetry across Europe, with a significant supply-side imbalance in western Europe, and the UK especially," says Sinha.

With this in mind, LPs are thinking carefully about the risk/reward trade-off the UK offers in comparison with elsewhere in Europe, and coming to the conclusion that, for the time being, looking elsewhere for private equity exposure is the right course of action. "LPs want to find where the alpha has moved to," says Sinha. "In Italy and Spain, for example, political risks are not too dissimilar to the UK at the moment, but entry multiples are 6-8x, rather than 10-12x."

A direct consequence of this continued pricing surge is that deal activity is tailing off. Where 231 buyouts were announced in the UK in 2017, with an aggregate EV of €41bn, Unquote Data tracked 166 buyouts with a total value of €21.2bn in the first three quarters of 2018. For LPs, this means that many still have a significant amount of capital waiting to be drawn down and deployed into the UK. "While sentiment may have cooled a little, LPs have a lot of undrawn capital in UK-focused funds, and so aren't withdrawing completely," says Sinha. "Many [LPs] are using Brexit as an opportunity to rebalance their portfolio, building exposure to elsewhere in Europe"

Pausing for breath

Although the headline figures are somewhat alarming, market participants are not overly concerned by the future prospects for the private equity market in the UK. "This is not really a reflection of investor demand," says Sinha, "but rather the market pausing for breath after a very active period."

As an industry, private equity is relatively agile, able to adapt to circumstances as and when necessary to take advantage of any opportunities that arise. The prospect of Brexit, while it might pose short-term issues, will also create market dislocations of the sort private equity investors are well set up to make the most of. "There's no reason why, over the longer term, the UK shouldn't offer good opportunities for private equity investments," says Willetts. "The issue at the moment is that people are unsure what these opportunities look like."

While the past few months have been difficult for UK fundraisers, LP appetite for the country over the long term is unlikely to diminish significantly, and GPs are not being put off coming to market. "Our pipeline for committing to UK funds is very strong," says Willetts. "We have had a lot of approaches from placement agents and also from our existing relationships and networks."

With question marks remaining over the UK's political and economic future, it is unlikely that there will be a return to the levels of fundraising activity seen in 2017 in the UK, and less established managers are likely to find fundraising the toughest. "During uncertainty, there's always a flight to quality," Sinha says. "As an LP, you won't be fired for backing Apax or Cinven, where looking at a smaller/emerging manager entails more risk. This gives larger managers a natural advantage."

As the most mature private equity market in Europe, many GPs in the UK have a track record of delivering returns across cycles, and as Europe's second largest economy, private investment opportunities will always be available. These facts mean the significant slowdown in fundraising seen in 2018 is likely to be temporary.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds