UI Gestion

UI Investissements launches impact SME fund

New fund will invest tickets of EUR 3m-10m in companies with more than EUR 1m in cashflow

UI Investissement, Geneo back clinic operator GBNA

UI and Geneo invest in the company via a capital increase, partnering with the Guichard family

Cap Grand Ouest 3 holds first close

Fund makes its first investment by acquiring a minority stake in healthcare consultancy Helpévia

IK sells Aposan to Ardian-backed Santé Cie

Sale ends an investment period of almost four years, during which revenues and EBITDA doubled

UI Gestion backs packaging manufacturer Sopac Medical

With the support of its investors, Sopac plans to further expand in France and internationally

Parquest, BPI France back JVS in OBO; Apax exits

Apax Partners, UI Gestion and the company's founders exit the investment

UI Gestion backs Daco France SBO

Directors Alain and Michel Abitbol retain stakes in the France-based dried fruits company

Demeter acquires Chesneau

Existing investor UI Gestion has reinvested in the company following its initial investment in 2011

UI Gestion closes Cap 6 on €105m

Mid-market focused Cap 6 is larger than its predecessor, M.I5, closed on €93.5m in 2011

Capital Croissance acquires Vlad from UI Gestion

UI Gestion sells its stake in France-based Vlad, while BPI France and management reinvest

Adaxtra et al. back Groupe Asia in MBO

GPs invest in tour operator Groupe Asia alongside the CEO and the Chantraine family

UI Gestion, Alliance Entreprendre back Treo BIMBO

Thierry Girardeau and Dominique Marrast are appointed as director and sales manager of Treo

Demeter backs Piscines Magiline in MBO

UI Gestion, BPI France, Esfin Gestion and BTP Capital remain backers of Piscines Magiline

Eurazeo buys ST Group in SBO

UI Gestion sells its stake in the sensitive areas security specialist, renamed Vitaprotech

Gimv, UI Gestion sell Almaviva Santé to Antin

Gimv and UI Gestion sell the French private hospitals group to Antin Infrastructure Partners

Idinvest, BPI, Ouest Croissance support Segex SBO

Edmond de Rothschild Investment Partners, UI Gestion and Socadif have fully exited the group

BNP Paribas, UI Gestion invest in La Boucherie

Existing backer Naxicap first entered the group in 2008 via an €8m expansion round

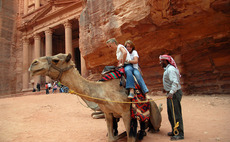

A Plus et al. create tourism group with Vedettes bolt-on

The new business will represent €35-40m in EV and remains majority-owned by its CEO

UI Gestion and Sofipaca sell Villas Prisme to Amundi et al.

GPs acquired respective 52% and 8% stakes in residential constructor through 2008 OBO

UI Gestion et al. in OBO for Jet Freeze

Maiden deal for UI Gestion’s latest fund

Gimv's Almaviva bolts on Paris hospital

Bolt-on increases Almaviva's 2014 revenues to €130m

NCI becomes majority shareholder of Didactic

UI Gestion and BPI France exit the business

Gimv, UI Gestion acquire Almaviva

Gimv and UI Gestion have acquired French operator of private clinics Almaviva Santé from 21 Partners, with each of the firms contributing €40m towards the buyout.

MML backs Tournus Equipement SBO

MML Capital Partners has acquired a stake in Tournus Equipement, a French manufacturer and distributor of stainless steel equipment for professional kitchens, from Qualium Investissement as part of a secondary management buyout.