United Kingdom

XAnge invests £1.2m in The Currency Cloud

XAnge Private Equity has invested ТЃ1.2m in UK foreign exchange capital services provider The Currency Cloud.

Nesta launches £25m impact investment fund

Nesta Investment Management, a subsidiary of innovation foundation Nesta, has launched a ТЃ25m impact investment fund, holding a first close on ТЃ17.5m.

KKR, CVC, Carlyle and Apax looking into bid for Urenco

Four of the world's largest private equity houses are thought to be considering bidding for British nuclear fuel provider Urenco, according to The Sunday Times.

Beringea backs InSkin Media

Beringea has led a ТЃ2m funding round for UK-based advertising technology and digital media specialist InSkin Media (ISM).

Albion launches top-up fund for six VCTs

Albion Ventures has started fundraising for a top-up fund targeting six of its VCTs, aiming for a total of ТЃ15m.

NVM-backed Kerridge buys Datawright

Kerridge Commercial Systems (KCS), an enterprise resource planning software firm backed by NVM Private Equity, has acquired Datawright, a business management software firm.

SL Capital appoints new partner and managing director

SL Capital Partners has promoted Patrick Knechtli and Mark Nicolson to partner and Jamie Ebersole to managing director in the firm's Edinburgh office.

Strong Q3 puts UK back on track

A strong third quarter showing in UK deal activity has helped put the market back on track for 2012, according to the latest unquoteт UK Watch, in association with Corbett Keeling.

Redx Pharma secures £4.7m for spinout

Redx Pharma has been awarded ТЃ4.7m from the British Regional Growth Fund to launch new subsidiary Redx Anti-Infectives Ltd.

SVB makes two senior hires for PE team

Silicon Valley Bank (SVB) has appointed a new director and new relationship manager for its UK private equity services group.

LP highlights misalignment of interest with GPs

LP slams GP fees

Octopus invests in IOVOX

Octopus Investments has backed London-based telephony analytics provider IOVOX, taking a minority stake in the business.

UK & Ireland unquote" October 2012

Prime Minister David Cameronтs much vaunted тbig societyт project finally got off the ground this month, with government-established investor Big Society Capital (BSC) making its first investments.

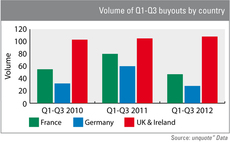

Data shows impact of continental crisis

Figures have outlined the extent to which the eurozone crisis, and other factors, have crippled the buyout market on the continent.

Index Ventures leads £8m funding for Secret Escapes

Index Ventures has led an ТЃ8m funding round for UK-based online luxury travel club Secret Escapes.

JC Flowers considers buying RBS assets

JC Flowers is reportedly considering a bid for 316 RBS branches worth up to ТЃ1bn.

Enterprise Ventures invests in Powelectrics

Enterprise Ventures (EV) has invested in UK-based sensors and telemetry business Powelectrics.

Palio plans £150m debt fund IPO

Debt fund Palio is planning an IPO to raise more than ТЃ150m for investment in debt opportunities for UK lower mid-market companies.

Cinven buys Amdipharm for £367m

Cinven has acquired UK-based pharmaceuticals business Amdipharm Group for ТЃ367m.

Enterprise Ventures backs LabelSneak

Enterprise Ventures has backed online men's fashion retailer LabelSneak with a ТЃ525,000 investment.

Carlyle awarded second extension for Chemring bid

Carlyle has been granted a second extension on its deadline to make an offer for British military supplier Chemring.

Notion and e.ventures lead $3.2m funding for Shutl

Notion Capital and e.ventures have led a $3.2m financing round for British delivery company Shutl.

Canaan Partners leads $26m round for borro

Canaan Partners has led a $26m funding round for UK-based personal asset lender borro.

Deloitte appoints Nick Soper as debt advisory director

Deloitte has named ex-Investec director Nick Soper as the new director of its debt advisory division.