Venture

Jeito holds €200m first close for maiden fund

France-based venture capital investor is planning to reach the fund's €500m target by Q4 2020

Google buys VC-backed Pointy

Following the acquisition, Pointy expects to build new features and further expand its offering

Eureka Venture launches maiden €50m VC fund

Fund follows several recent launches of early-stage-focused vehicles across southern Europe

Five Elms et al. back SimpliField $11m series-A

SimpliField plans to use its most recent fundraising round to expand in the US

Five Seasons et al. back Just Spices series-B

Online spice and cooking kit marketplace plans to use the €13m investment to expand to new markets

SET Ventures Raises Fund closes third fund on €100m

Dutch VC closes the fund, launched in Q1 2019 and focusing on energy transition

Accel-KKR leads $50m round for Partnerize

Accel-KKR principal Joe Porten will join the Partnerize board of directors as a part of the deal

K Fund et al. in €3m round for Bob.io

Company plans to expand internationally and develop new services for passengers' needs

Consortium in €36m series-B for NorthSea Therapeutics

US-based VCs VenBio and Sofinnova Investments back the business for the first time

Versant Ventures et al. back VectivBio

The $35m investment will be used to launch the biotech company following its spin-out from Therachon

OTPP et al. in €140m round for Kry

Founded in 2015, Kry had already raised in excess of тЌ80m prior to this round

Venture Stars et al. back Finoa

Blockchain startup aims to use the fresh capital to broaden its service offering and grow its team

SmartFin closes sophomore fund on €240m

Belgian early-stage and growth fund will provide €500,000-12m equity tickets

Slingshot, Shoe back Swishfund

Fresh capital will help Swishfund to develop its software and expand its client base

Insight Partners et al. in £55m round for Receipt Bank

Accountancy software platform also drew investment from Kennet Partners and Augmentum Fintech

Volta collects €35m for Volta Ventures II

New vehicle will provide funding to Benelux-based software and internet startups

Swiss and German venture peaks in Q3 2019

Aggregate value of venture deals in Germany soared to more than €2.73bn across 85 deals

Mubadala leads €150m series-E for delivery platform Glovo

Previous investors Drake Enterprises, Idinvest and Lakestar also take part in the round

Tesi et al. back $15m series-C for BC Platforms

Company will use the fresh capital to expand its global network of clinical and genomics data

Summit leads $90m round for Odoo

Sofinnova invested in a €3m funding round for the enterprise management company in 2010

Octopus, Calculus lead £3.6m round for Fiscal

Octopus draws equity from its Apollo VCT for the investment, which manages ТЃ30m

Elbrus leads $10m round for YClients

Elbrus is currently investing from its $550m vehicle, which held a final close in February 2014

Iris Capital, Idinvest et al. inject $12.3m into Yubo

Iris, Idinvest and historical backers invest in the manager of the eponymous social media app

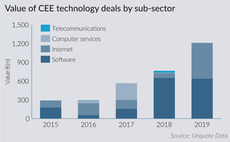

Software sector lures increasing amounts of capital in CEE

Interest in the software sector in CEE is on the up and was especially prominent in Q3