Venture

Ada holds first close on £27m

Ada Ventures' founding partners, Francesca Warner and Matt Penneycard, met at Downing Ventures

HV Holtzbrinck leads €8.8m seed round for Finn.auto

Danish VC Heartcore Capital, UVC Partners and existing investor Picus Capital also take part

Accel leads $11m series-A for Tines

Deal is an extension of the $4.1m series-A funding round led by Blossom Capital in October 2019

Omers Ventures et al. back $110m round for WeFox

Round brings the series-B total to $235m and values the digital insurance provider at more than $1bn

VCs in £7m round for Perlego

Perlego offers access to online textbooks for a subscription fee of ТЃ12 per month

Idinvest leads $50m round for Ogury

Idinvest is currently investing from its тЌ350m vehicle, which held a final close in October 2019

Mobeus invests £4m in IPV

Calculus Capital invested тЌ2.5m in the media management software provider in 2015

Paris takes over London as VC capital of Europe

Greater Paris region received €3.1bn between 2007-2015, according to Invest Europe research

Karma et al. back €1.5m round for MeetFrank

Company will use the capital to launch its new "relocation without location" feature

Omers Ventures leads $5.2m round for Quorso

Business software company intends to use the investment from the series-A round to expand abroad

Asabys leads €20m round for Anaconda Biomed

Previous backers Ysios Capital, Sabadell Venture Capital, Innogest and Omega Funds also take part

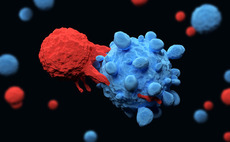

VC-backed ImCheck Therapeutics raises $53m series-B

Round is co-led by BPI France and Pfizer Ventures, the venture capital arm of pharmaceutical giant Pfizer

Umbra leads $20m round for Hastee

In addition to the equity investment, Hastee receives a $250m credit line from the investors

VCs in £15m round for Cuvva

Cuvva has recently launched its first product, where customers pay monthly for insurance

Signa Innovations leads €5m series-A for Realxdata

Paris-headquartered Ventech also backed the round for the Berlin-based data analysis software company

VCs in £10m round for Uncapped

Accelerator Seedcamp also invested in the round, as well as several angel investors

NPM Capital et al. in €250m series-C for Picnic

Company will use the fresh capital to develop a robotised distribution centre in Utrecht

YFM, Comhar invest £4.5m in PanIntelligence

YFM is investing ТЃ3.5m for a minority stake, alongside an additional investment of ТЃ1m by Comhar

Lightspeed leads €128m round for Vinted

Funding round values Vinted at €1bn, making it Lithuania's first technology unicorn

Octopus, Downing and C4 in $21.8m round for Trouva

Fresh capital from the investment will be used for overseas expansion and software development

DN Capital et al. lead €5.5m series-A for Cognigy

AI software platform intends to use the second round of funding for US expansion

Ten Eleven, Seaya lead $11m series-A for Buguroo

Existing investors Inveready and Conexo Ventures also take part in the funding round

EV Private Equity-backed EWT acquires IKM

EV Private Equity is currently investing from Energy Ventures IV, which closed on тЌ247m in 2011

Digital+ Partners leads €23m series-B for Pricefx

Pricefx intends to use the fresh capital to invest in sales and marketing, and to expand in the US