Venture

Entrepreneurial spirit helps French VC fundraising rebound

Venture fundraising reaches 2016 levels with two months left of the year, with early-stage and expansion dealflow also on the up

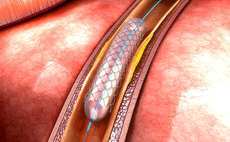

Sofinnova leads €12.3m round for Highlife

Following the deal, Sofinnova will become the largest shareholder in the business

HTGF backs seed round for Ferroelectric Memory Company

Company takes advantage of a new semiconductor memory technology for non-volatile storage

Truffle et al. exit Vexim in €162m Stryker deal

US-based Stryker Corporation acquires French VC-backed company Vexim for €162m

Ataraxy leads €6m series-B for Nicki's

Series-A investor European Media Holding also takes part in the latest funding round

Point Nine Capital in $14m funding round for Brainly

Other backers include Kulczyk Investments, Naspers, General Catalyst and Runa Capital

Idinvest Partners, BPI France et al. in €32m iAdvize series-C

French GPs invest €32m in the conversational marketing platform developer

SevenVentures invests €13m in series-C expansion for Move24

Original round was led by Innogy Ventures with Holtzbrinck, DN, Piton and Cherry participating

Capnamic, Grazia in $8m round for Zageno

Fresh capital will be used to expand the sales, marketing and technical integration teams

Primomiglio leads €1m seed round for Yolo

Backers include US-based seed investor Miro Ventures and insurance broker Mansutti

Endeit leads $10m series-B for Tourradar

Existing investors Cherry Ventures and Hoxton Ventures also take part in the round

Tesi launches €150m venture fund-of-funds

VC firm intends to deploy capital into Finnish venture capital and small buyout funds

VC firms invest €3.6m in Blickfeld

Fluxunit, HTGF, Tengelmann and UnternehmerTUM all take part in the funding round

Global Founders in £36m Nested round

Online estate agent will target expansion in London before looking to grow across the UK

Invitalia hits €87m final close with EIB commitment

Fund has already invested €11m in 16 Italian startups and currently has €33m in AUM

Circularity and Mustard Seed co-lead $7.4m round for Winnow

Business will roll out its software for tracking food wastage across new international markets

Auven leads $200m round for ADC Therapeutics

Hedge fund Red Mile, the Wild Family Office and VC Astrazeneca also back the round

Paladin and VT Partners join forces on cybersecurity investments

The two firms intend to share resources, knowledge and networks through the agreement

Korelya to manage extra €100m on behalf of Naver

Venture player Korelya is headed by former French secretary of state Fleur Pellerin

German VC firms back €19m series-C for Global Savings

Rocket Internet, Holtzbrinck Ventures, Deutsche Telekom Venture Funds, Ru-Net and Deutsche Bank take part

Spectrum holds final close on $1.25bn hard-cap

GP will make investments in IT companies ranging from $25m up to more than $100m

Otium Capital and Kima Ventures in €2m round for Comet

Venture capital funds back startup, which connects freelancers with companies who need staff

BGF invests £2.65m in Monodraught

BGF introduces Ewan Wilson, formerly of HellermannTyton Data, as non-executive chair

Ixo et al. in €7.3m round for Antabio

Irdi Soridec Gestion, Galia Gestion and the company’s previous investors also take part