Venture

Digital+ Partners gears up for fundraise

GP focuses on later-stage B2B technology companies and closed its previous fund in 2018 on €350m

Early-stage investor Antler closes Nordic fund on €29.6m

Fund was oversubscribed and includes Draper Esprit, Kistefos, VУІkstfonden and Investinor as LPs

Airbridge Investments contemplates new fundraise

Fund could tap family offices and wealthy individuals, while the VC's founders have so far invested their own capital

Advent leads $220m series-D for Shift at $1bn valuation

Avenir, Accel, Bessemer Venture Partners, General Catalyst and Iris Capital also take part in the round

Azimut buys 30% stake in VC house P101

With this partnership, Azimut and P101 intend to develop a European platform to fuel the growth of innovative companies

CVC leads growth investment in Acronis

Cybersecurity software developer is valued at $2.5bn, compared with $1bn at its last funding round in 2019

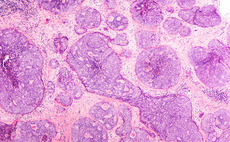

NeoGenomics buys VC-backed Inivata for $390m

Inivata will become a separate business division alongside NeoGenomics' clinical, pharma and informatics units

Amadeus V Technology Fund closes on £110m

Fund invests in seed and series-A startups specialised in science and engineering-led innovation

Founders Circle closes third fund on $355m

Fund deploys flexible capital to meet the needs of growth-stage companies and support their expansion

Greyhound leads $160m series-D for TravelPerk

This injection, which includes both equity and debt, brings the total capital raised by TravelPerk to date to $294m

VCs in $75m round for Kaia Health

Digital physical therapy platform is backed by all existing investors, including Balderton Capital

Novo Seeds, Ysios Capital lead €51m round for Adcendo

RA Capital Management, HealthCap and Gilde Healthcare also take part in the round for the biotech startup

Lumos leads €70m series-C round for OpenClassrooms

Education technology company also attracts Salesforce Ventures, Chan Zuckerberg Initiative and GSV Ventures

Arcline buys PTS from Columbus

Arcline intends to boost PTS's growth through the expansion of its production and its technology portfolio

Softbank leads $225m series-D round for Exscientia

Japanese investor provided additional $300m equity commitment that can be drawn at the company's discretion

Dorilton launches venture strategy to target tech companies

Dorilton Ventures will lead significant minority investments in early- to mid-stage data-centric technology companies

CPPIB, Fidelity lead €262m series-D round for Kry

Company was founded six years ago and has so far raised nearly тЌ500m over five rounds

Prosus, Tencent lead $80m round for Bux

ABN Amro, Citius, Optiver and Endeit take part in the round, alongside previous backers HV Capital and Velocity

Digital Alpha Fund II closes on $1bn

Fund invests in digital assets, with a focus on next-gen networks, cloud computing and "smart cities"

KKR leads €100m series-C for Ornikar

Existing investors Idinvest, BPI, Elaia, Brighteye and H14 also took part in the fundraising

Columbus Life Sciences Fund III closes on €120m

Fund invests in early-stage and high-growth opportunities across the life sciences and pharmaceutical industries

Inovo II holds €54m final close

Fund intends to fuel the development of the startup ecosystem across the CEE region

Jolt, Tesi et. al in €30m round for Virta

With the funding, the Finnish company will seek to expand into Asia, which it said was one of the largest markets for EV charging alongside Europe and North America

Primo Digital Fund launches with €80m target

Fund has a special focus on the e-commerce, software, cybersecurity, fintech and blockchain sectors