Analysis

GP Profile: Arcadia

CEO Simone Arnaboldi discusses the firm's recent investments, its current pipeline and the prospect of launching a new fund

Sharp focus on top assets boosts average multiple in consumer sector

Covid-resilient assets are the only ones coming to market, with suitably hefty price tags, says Clearwater's O'Donnell

Nordic players await distressed carve-out uptick

Carve-out activity in the Nordic region hit a three-year low last year, but was still propped up mainly by corporates divesting healthy assets

Biotech market provides dose of optimism

In the past year, the biotech market has seen buoyant activity, reaching record levels of investments

No need to panic about high dry powder as PE market comes roaring back, says Bain

Appetite remains high for deal-making and exits, according to Bain & Companyтs 2021 Global Private Equity Report

France: strong deals pipeline fuels high average entry multiple

Sponsors fight tooth and nail for prized assets in defensive sectors such as healthcare, higher education and financial services

GP Profile: Energy Impact Partners

EIP managing partner Matthias Dill discusses the firm's origination network, its sector focus, and impact investing in a more competitive era

Video: "A day in the life" of Beringea CIO Karen McCormick

McCormick shares her experience of a typical day working from home, and her outlook for venture and growth capital trends in 2021

DACH exit rebound expected in H2 2021

DACH PE players completed 16 exits in January 2021, compared with 14 in January 2020, hinting at signs of a gradual recovery

Q&A: 17Capital's Thomas Doyle

"We see no ceiling for the adoption of NAV-based financing as a standard tool for portfolio management"

Video: Healthcare Sector Focus virtual event

Expert speakers discuss the short-term impacts of Covid-19, as well as the longer-term effect on traditional healthcare infrastructure

Unquote Private Equity Podcast: Venture's immunity

Simon Philips, CEO of ScaleUp Capital, joins the Unquote podcast to explore recent trends in the European venture space

GP Profile: Clessidra

CEO Andrea Ottaviano discusses the launch of the firm's last buyout fund, as well as dealflow and market perspectives in the wake of Covid-19

LP Profile: IMCO

Managing director Craig Ferguson discusses accelerated deployment activity during the pandemic and plans to scale up the PE allocation by 2025

Secondaries set for bumper year as dry powder overhang remains

The market is gearing up for a flurry of secondaries investing in 2021 with an estimated $61bn deployment target

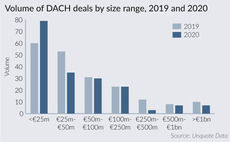

DACH small-cap deals weather the storm

Small-cap dealflow remained fairly stable in the DACH region in 2020, despite the coronavirus crisis

Evolving VC landscape helps fuel venture secondaries

Backing a portfolio of companies after various funding rounds gives comfort to some investors, with valuations seen as more concrete

DACH venture and growth deals peak in crisis

Following a strong year in volume terms, market participants remain optimistic about the resilience of the venture ecosystem

Southern Europe's VC industry grows amid pandemic

VC ecosystem has not been immune to Covid-19, but has been able to react more promptly than traditional segments of the PE market

Unquote Private Equity Podcast: Nordic 2020 Review

Katharine Hidalgo welcomes Unquote Nordic reporter Eliza Punshi to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

2021 Preview: Dry powder drives DACH prospects for 2021

DACH players adopted increased portfolio management and defensive investment decisions in 2020, but dry powder is set to drive 2021

Unquote Private Equity Podcast: DACH 2020 Review

Katharine Hidalgo welcomes Unquote DACH reporter Harriet Matthews to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

Unquote Private Equity Podcast: France 2020 review

Katharine Hidalgo welcomes Unquote editor Greg Gille to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

Unquote Private Equity Podcast: UK & Ireland 2020 Review

Early figures highlight how a 2008-style meltdown was averted in 2020, both in terms of deal-doing and fundraising