Analysis

LP Profile: Industriens Pension

LP's head of private investments, Ostergaard, speaks to Unquote about allocation strategy, co-investment and first-time funds

French PE market overtakes UK

With a stark drop in H2, the UK's buyout volume looks certain to finish the year short of 2017's total

Unquote Private Equity Podcast: From Brexit fears to record years

Listen to the very first edition of the Unquote Private Equity Podcast, where the team discusses 2018's hot topics across European PE

European PE in 2019: Paying a premium

Leading industry practitioners discuss private equity developments throughout 2018 and analyse emerging trends for the year ahead

Q&A: Sebastien Canderle

Unquote catches up with Sebastien Canderle to discuss his latest book and his views on private equity

PE and the banking sector: a challenging marriage

Fund managers are increasingly investing in the banking space, despite regulatory challenges and potential conflicts of interest

Brexit apprehension brings sharp drop in UK deal activity

Country suffers a larger drop-off in aggregate buyout value than any other European region in the first 11 months of 2018

French PE investment in aerospace soars to new heights

Asset class is fuelling growth in the industry, with aggregate value in France picking up pace in recent years

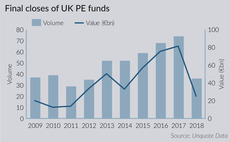

Brexit puts the brakes on UK fundraising

Country records its sharpest decline since the turn of the century in 2018, with anxiety around Brexit chief among investors' concerns

Q&A: Hermes GPE's Elias Korosis

Unquote speaks to the LP's head of growth investing about gaining access to the best deals and being a good partner to GPs

Video: EQT's Hanna Grahn talks ESG, impact investing

EQT senior sustainability specialist Hanna Grahn discusses the firm's approach to ESG and impact

Video: Goodwin's Ed Hall on Nordic macro trends

Goodwin partner Ed Hall recaps a macro-focused panel at the latest Nordic Private Equity Forum

Mega-funds ignite Nordic nations

Region's PE fund managers raised the highest annual aggregate commitments on record in the first three quarters of the year alone

LP Profile: Vækstfonden

Unquote speaks to chief investment officer Kjærgaard about the LP's investment programme and its focus on the Danish ecosystem

Attracting tech talent top priority for Nordic GPs

Industry players at the Unquote Nordic Private Equity Forum discussed the region's track record and future challenges

Italy's battle with EU raises risks for private equity

Stand-off surrounding Italy's draft 2019 budget threatens to derail recent progress in the country's PE landscape

DACH region rises up Europe's PE ranks

Frankfurt proves the most popular city, with KKR, Astorg, Idinvest et al. opening offices in the city

Q&A: Forbion Capital Partners' Sander Slootweg

Managing partner at the life-sciences-focused VC speaks to Unquote about fundraising, pursuing a 'build' strategy and the European market

GP Profile: Auctus Capital Partners

Unquote speaks to the firm's founding partner, Ingo Krocke, about Auctus's evolution and a continued focus on the lower-mid-market

Single-asset funds afford slow and steady pace

When a fund approaches the end of its lifespan, transferring the last remaining investment into a new vehicle is proving increasingly popular

French travel sector deals take off

Investments have rebounded in 2018, with the perception of geopolitical threats subsiding and shifts in consumer habits presenting opportunities

GP Profile: Tikehau Capital

Unquote speaks to UK head Cirenza about the asset manager's evolution and experience investing across the capital structure

Q&A: Inverleith's Paul Skipworth

Unquote speaks to managing partner Skipworth about fundraising process and deploying capital in the embattled UK consumer space

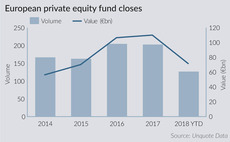

European fundraising cools down after bumper 2017

Number of fund closes by European PE firms and their aggregate commitments have slowed down during 2018, following two years of relentless activity