Analysis

Voting ends today: British Private Equity Awards 2012

British Private Equity Awards

DACH region turns a corner

DACH region turns a corner

Would the real CEE please stand up?

Confusion over CEE stats

Leveraged finance "at tipping point"

Royal Bank of Scotland, Lloyds TSB, Barclays, HSBC т all names that can be seen on high streets across Britain. From credit cards to mortgages to investment banking and acquisition finance, these powerful institutions once had the UKтs credit market tied...

AXA PE kicks it up a gear in 2012

AXA Private Equity (AXA PE) may have mainly attracted attention last year with the start of its spin-off from French insurer AXA, but the firm is letting its deal teams do the talking in 2012. Greg Gille reports

PE firms lose Fondiaria to Italian inner circle

PE firms lose Fondiaria

Top 5 buyouts of 2012 so far

Top 5 buyouts

Can celebrities make it in private equity?

Celebrities in PE

Trade buyers buoy mega-exit market

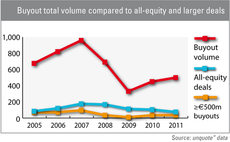

While large buyouts have been a rare creature in private equity since the eurozone crisis exploded last year, the mega-exit is making a strong return to the fold, according to research by unquote” data.

Olympic legacy to accelerate UK venture

Accelerating European venture

PE rakes in record €45bn management fees

The global private equity industry is now thought to be managing some $3trn in assets. An impressive figure, but can the industry continue to grow in assets under management and sustain itself or is it now doomed to a slow decline?

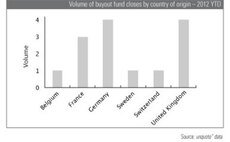

Competition heats up for German fundraising

Deutsche Beteiligungs AG (DBAG) last week closed Germany’s biggest fund since 2007. While the country’s fundraising environment has been paid little attention in recent years, it has seen as many fund closes in 2012 as the UK. John Bakie investigates...

United against private equity

PE's public image

Spain sees opportunity in disaster

Opportunity in disaster

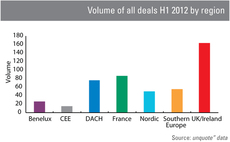

UK dominant as European deal activity stumbles

The UK has reasserted its dominance as a European private equity market in 2012, racing ahead of the competition, according to figures from unquoteт data.

Video: Natural attrition of GP relationships to accelerate – Capital Dynamics' Katharina Lichtner

Video: Capital Dynamicsт Katharina Lichtner

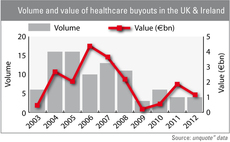

Are buyout firms well placed for healthcare reforms?

UK healthcare

The State at play: Italian government jumpstarts flat market

The State at play

Mid-cap GPs pay less than corporates as entry multiples drop

For the first time in two years, between April and June, private equity houses paid a lower median entry multiple than corporate buyers in mid-cap transactions, according to the latest Argos Mid-Market Index.

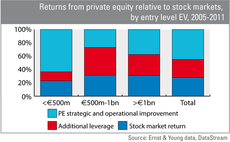

Mid-market leads value creation

Mid-market leads value creation

Will Luxembourg lose prime spot as fund domicile?

Luxembourg losing out?

Renewed confidence in alternative energy

Alternative energy

Video: Jonathan Blake advises on fundraising

Video: Jonathan Blake