Analysis

French fundraising: Out in the wild

French fundraising

Q&A: Taylor Wessing on tech investment

Q&A: Taylor Wessing

Sponsored video: Secondcap's François Gamblin on the secondaries market

Video: Secondcap's François Gamblin

Video: Arle's John Arney on the European buyout market

Video: Arle's John Arney

LP interview: Talis Capital's Vasile Foca and Matus Maar

LP interview: Talis Capital

Sponsored video: The PE software solutions market

unquote" news editor Greg Gille discusses current trends in the private equity software solutions market with eFront founder, president and CEO Olivier Dellenbach.

Q&A: AFIC's Louis Godron

Q&A: AFIC’s Louis Godron

Fund managers left out on red tape reduction

UK environmental legislation

German family businesses & PE: An uneasy relationship

German private equity firms are hungry for the Mittelstand, but these largely family-run businesses have often proved elusive in the past. Will more partnerships emerge as a consequence of the economic crisis and diminishing availability of conventional...

LPs getting to grips with private equity's bad reputation

PE's image issue

LP interview: Morgan Stanley AIP's Neil Harper

LP Interview

Secondary buyouts continue to boom, but for how long?

The European secondary buyout market is deeper and more active than the primary market, but buyers should beware that its health is ultimately dependent on the same factors that drive primary transactions. Anneken Tappe reports

Video: AXA Private Equity's Stefano Mion

Stefano Mion, the head of AXA Private Equity's UK operations, talks to unquote" news editor Greg Gille about the firm's fund-of-funds strategy.

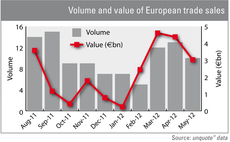

Trade sales on the rise

The partial sale of Alliance Boots to Walgreens by KKR and AXA PE is the latest in a series of exits propping up trade sale figures in 2012. Meanwhile the secondary buyouts trend is showing signs of abating. Greg Gille reports

Rise in secondaries highlights tough venture market

Venture secondaries on the rise

Video: EBRD's Anne Fossemalle

unquote" editor-in-chief Kimberley Romaine speaks to EBRD director Anne Fossemalle about the latest trends in manager selection.

Turnarounds expect deal flood post-Olympics

The Diamond Jubilee and Olympics are detracting from private equity activity, though banks could at last be ready to sell their equity investments. Kimberly Romaine reports

Private companies rethink pricing

The recession has had little effect on company valuations, but now companies are becoming more realistic about their value, writes John Bakie

Trade winds blowing

Trade winds blowing

Listed private equity recovery underway

Listed private equity

The Nordic coming-of-age

The Nordic coming-of-age

PE players cashing in on energy services consolidation

Environmental, social and governance (ESG) issues are becoming more important to businesses, leading to the emergence of intense private equity interest in the energy management services sector. Research by Robert W Baird suggests an increase in deal...

Macro challenges make manager selection crucial

The Nordic region has enjoyed a boon of LP interest in recent years, but global economic woes will make outperformance harder. Kimberly Romaine reports from Stockholm

Netherlands: Out of sight for foreign GPs?

The latest market report from the Dutch private equity association (NVP) shows that GPs in the Netherlands have strengthened their position between 2010 to 2011. However further research by unquote" data reveals that the participation of international...