Research

European buyout value reaches post-crisis high

Deal value has been boosted by a spike in тЌ1bn+ deals and strong activity in Southern Europe

Creative Credit in Private Equity

Creative Credit in Private Equity is now available to download for our subscribers

PE-backed IPOs hit nine-year low

Of the 617 European exits so far this year, only 17 have been IPOs, equivalent to 2.7%

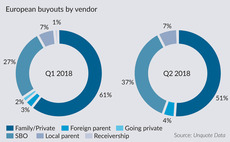

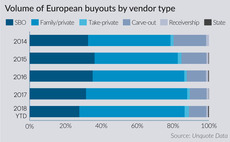

Record SBO numbers helped drive buyout dealflow in Q2

Q2 2018 saw 94 buyouts sourced from other GPs, setting a new quarterly record for European private equity

Q2 Barometer: European private equity hot streak continues

Average European PE deal value hit a post-crisis peak in Q2, while quarterly volume reached the highest level on record

Record number of French SBOs and mega-deals in H1 2018

France's year is going from good to great as new figures from Unquote Data show buyout volumes reaching their highest level for a decade

Italian PE back in fashion

Despite a drop-off in 2017, total Italian PE value last year is still almost double that of the €4.1bn invested in 2012

DACH Fundraising Report 2018

Private equity fundraising in the DACH region continued to build on strong momentum in 2017

Q1 entry multiples drop to lowest level since Q1 2016

PE deal valuations drop for the third consecutive quarter, as the Nordic region continues to see the highest entry multiples

France Fundraising Report 2018

The first quarter of 2018 has set the tone for what is likely to be a busy year for fundraising in the region

Q1 Barometer: Mega-deals propel value to post-crisis record

Deal volume reached the second highest quarterly level in two and a half years, while aggregate value climbed to тЌ54bn

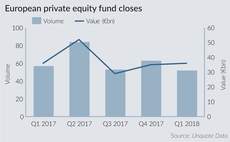

European fundraises off to healthy start in 2018

Number of fund closes and aggregate capital raised in Q1 is roughly on par with the same period last year, but short of the strong start to 2016

Secondary buyouts hit 10-year low in Q1

Proportion of deals sourced from fellow PE firms has ebbed back to the level last seen in 2007, according to Unquote Data

European entry multiples hit new high in 2017 despite Q4 cooldown

Average EBITDA multiple increased to 10.4x in 2017 compared with 10.2x in 2016, according to the latest Clearwater Multiples Heatmap

Annual Buyout Review: Lower-mid-market momentum lifts dealflow

Unquote's lastest Annual Buyout Review is now available to download for subscribers, offering in-depth statistical analysis of 2017 activity

Large-cap deals drive strong start to 2018 for European PE

GPs deploy an extra тЌ7bn in aggregate value across European buyouts in the first two months of the year compared to 2017

Q4 Barometer: Deal volume and aggregate value slide

Despite a boom in both dealflow and aggregate value across 2017 as a whole, the final quarter of the year saw a slowdown in activity

CEE Fundraising Report 2017

An in-depth statistical analysis of recent fundraising trends in CEE, with insight from local experts, now available to download

UK & Ireland Fundraising Report 2017

Proprietary statistics on the local fundraising market and insights from leading practitioners and LPs

Q3 Barometer: Market pauses for breath

European dealflow slows down compared with previous quarter but remains at historically elevated level

Average entry multiple climbs to 10.8x in Q2

Price inflation has led average European multiples to rise further in Q2, according to the latest unquote" and Clearwater Multiples Heatmap

DACH Fundraising Report 2017

Private equity fundraising in the DACH region, as in the rest of Europe, is seeing continued strength

Q2 Barometer: Aggregate PE deal value reaches 10-year peak

Deal numbers climbed for the second consecutive quarter, boosted by buyouts and growth capital deals

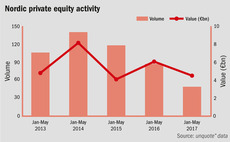

Nordic fundraising market remains buoyant despite dealflow dip

In the first part of our 2017 Nordic Fundraising Report, unquote" examines statistics for the local market across 2013-2017