Research

Average multiples remain stable at 10.2x in Q1

European valuations keep track with 2016, but drop slightly compared to Q4 2016

Q1 Barometer: Fall in buyouts sees aggregate value drop 30%

Early-stage and expansion deals up, while buyout volumes and values drop

French dealflow hit record high in 2016

After years of failing to exceed UK dealflow, the country finally clinched the top spot of the European league table in buyout volume

Steady growth driven by smaller deals in Benelux

The Benelux region recorded a fourth successive increase in buyout volumes, thanks to strong activity in the smaller size brackets

Italy's aggregate value soars in 2016

Despite a slight dip in deal volume, Italy witnessed a 38.3% increase in aggregate value terms in 2016

Short-term consumer boost eases probable Brexit fallout in UK

Inflation, wage stagnation and trade uncertainty threaten the UK and Irish private equity markets post-Brexit

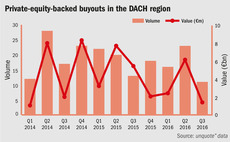

DACH proves its value with highest volume increase rate in 2016

Buyout activity in the DACH region witnessed the highest increase rate in deal volume across Europe in 2016

Iberia continues resurgence despite political drama

Positive macroeconomic outlooks, coupled with plentiful debt and renewed international interest, have nullified the effects of political instability

Aggregate value drops as Nordic assets look to public markets

Private equity firms are battling with stock exchanges for the affection of businesses in search of capital in the Nordic region

Larger deals underpin solid CEE performance

The appearance of larger buyouts drives values up and highlights growing maturity in the region

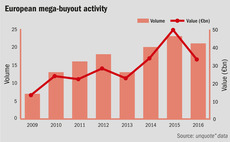

Large-cap European PE cools down as smaller dealflow regains footing

The European buyout market was back to growth in volume terms in 2016

European entry multiples rise to 10.2x in 2016

CEE, southern Europe and the Nordic region drive average price increase, while UK valuations drop

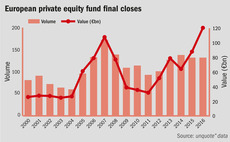

European fundraising surpasses pre-crisis high

Funds investing in Europe raised €120bn in 2016, up 37% on the year before

Q4 Barometer: Large-cap deals boost value in a shrinking market

Spike in megadeals boosted aggregate deal value in Q4, though volume was down 20% year-on-year

unquote" LP and secondaries round-up

European fund-of-funds managers look to raise new vehicles, LPs increase private equity allocations, and more in this unquote" round-up of LP news

unquote" data snapshot: the five biggest buyouts of 2016

The year’s two largest deals, somewhat unusually, took place in Italy and Poland

unquote" LP round-up

LPs in Europe increase private equity allocations; a Dutch investor searches for new fund managers; and much more feature in this unquote" round-up of LP news

UK dealflow suffers sharp drop post-Brexit

Aggregate value across the market is down by more than half year-on-year between July and November

Q3 Barometer: Core mid-market buyouts return to growth

Mid-market deal volume across Europe reached its highest total in five quarters

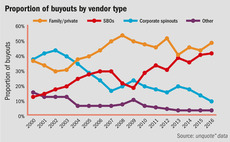

Secondary buyout levels reach new heights

SBO market in Europe has developed steadily over the last 15 years

unquote" LP and secondaries round-up

An overview of recent news and events regarding private equity LPs and secondaries deals

European entry multiples rebound in Q2

Following a dip in Q1, multiples for European PE-backed buyouts have returned to 2015 levels

Polish buyouts keep CEE afloat

Poland has established itself as the largest buyout space in CEE

DACH buyout dealflow hits 15-month high in Q2

Buyout volume and aggregate value were up by 43% and 155%, respectively