Capital Dynamics

Capital Dynamics holds EUR 300m final close for Future Essentials II

Managing director Mauro Pfister speaks to Unquote about the firm's strategy and steady deployment

Capital Dynamics Global Secondaries V closes on $786m

Fund invests in a diversified portfolio of global secondaries interests in mid-market private equity funds

Entangled, Capital Dynamics back SM Pack

GPs plan to support the company's growth both organically and via add-ons, while boosting its international expansion

Capital Dynamics closes fund-of-funds for DACH LPs on €208m

Vehicle will invest in buyout funds globally with a strong focus on mid-market buyouts and growth capital

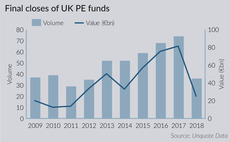

Brexit puts the brakes on UK fundraising

Country records its sharpest decline since the turn of the century in 2018, with anxiety around Brexit chief among investors' concerns

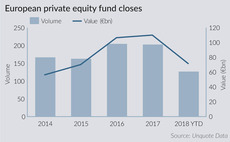

European fundraising cools down after bumper 2017

Number of fund closes by European PE firms and their aggregate commitments have slowed down during 2018, following two years of relentless activity

Debut funds flourish in UK market

First-time fundraisings are increasingly frequent in the UK, with 2017 seeing the most final closes of maiden funds for five years

Capital Dynamics holds $383m final close for co-invest fund

Vehicle surpasses its $350m target after holding an interim close on $200m in May 2017

GPs view ESG as value builder – Capital Dynamics survey

Alternative assets manager Capital Dynamics surveyed 109 GPs globally about responsible investment and ESG

Capital Dynamics raises $564m secondaries vehicle

Closing $200m above target, the fund is the largest-ever secondaries vehicle raised by the GP

Abundant dry powder fires secondaries prices sky high

This second installment of our secondaries focus takes an in-depth look at pricing trends

Prime-time for secondaries

The secondaries segment has clearly been popular with LPs, but can it cope with mounting levels of dry powder?

Navigating the complex world of co-investment

unquote" gleans insight from Capital Dynamics' David Smith on the intricacies of co-investment

Co-investments in clover

In this sponsored article, Capital Dynamics highlights complexities and resources required for co-investing

Germany: Investor confidence is the issue, says IKB's Bauknecht

Investor confidence is the issue, says IKB’s Bauknecht at the unquote" DACH Forum in Munich

GP churn boosts IRR

Further to initial findings announced in 2011, additional research by Capital Dynamics and London Business School’s Coller Institute of Private Equity has concluded that higher team turnover in buyout houses improves overall performance.

European venture: patience rewarded

Patience rewarded

Recipes for success in Asian markets

PE in Asia

UK private equity industry proves downturn resilience

UK private equity and venture capital funds generated a 6% 5-year IRR during the five years throughout the financial crisis, outperforming the 2.5% achieved by the FTSE All-Share, according to a recently published study.

Capital Dynamics and Arx buy Fincentrum

Capital Dynamics and Arx Equity Partners have bought a majority stake in Czech financial advisory services provider Fincentrum for an estimated CZK 750m.

Capital Dynamics' Lichtner to stand down from operational duties

Katharina Lichtner, co-founder and managing director of Capital Dynamics, will step down from her operational role at the firm and act as senior adviser as part of a wider senior management reshuffle.

German funds: The LPs' verdict

LP verdict

Capital Dynamics to close Zurich office

Swiss private equity firm Capital Dynamics has confirmed it will be closing its Zurich office within the next few months, relocating staff to its Zug and London offices.