UK buyout activity sets new record in Q1

The volume of buyouts inked in the UK and Ireland boomed in Q1, vastly outpacing previous first quarters and setting a new quarterly record, Unquote Data shows. Greg Gille reports

The UK buyout market is truly back in full swing, according to preliminary figures from Unquote's proprietary database. Fuelled by pent-up appetite to invest on the PE side, as well as a rush for vendors to complete deals before a potential capital gains tax (CGT) hike in the March budget, the market saw a record volume of buyouts in the first quarter.

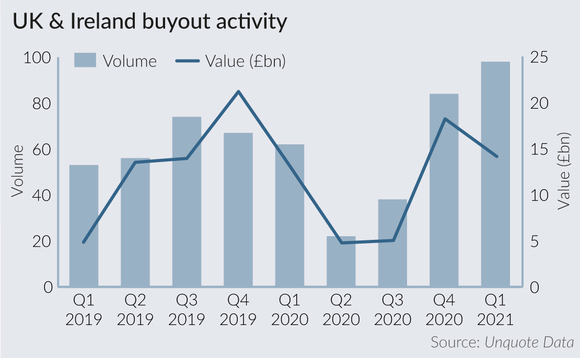

The UK and Ireland were home to 98 transactions between January and March (often reflecting processes initiated and progressed in Q4 last year), for an aggregate enterprise value of £14.1bn. The volume figure is a 16% increase on an already exceptionally busy Q4 total, and a 58% uptick on the 62 deals inked in Q1 2020 – although it has to be noted that the sharpest increase in recent months happened in Q4 2020, with volume more than doubling and aggregate value more than tripling compared with Q3.

Q1 2021 has now set a new all-time record for quarterly buyout activity in the UK, beating the previous record set in Q4 last year (84 deals). The busiest quarter in the decade prior to that was Q3 2019, with 74 deals recorded.

"We went into the start of the new year with as strong a pipeline as we've ever had," a partner at a small-cap GP tells Unquote. "The potential CGT rate hike may have been somewhat of a false deadline giving a sense of urgency, but the pipeline continues to build and we are still seeing a lot of attractive opportunities out there. Entrepreneurs are really focused on what they want out of a financial partner, and advisers have also upped their game when it comes to running tailored, focused processes for these businesses."

The amount of dealflow in the past six months underscores how much dry powder is left in the coffers of PE players targeting the UK market. In the past five years (which would be the typical investment period of a traditional closed-ended fund), Unquote has recorded 137 final closes of UK-based buyout vehicles, for aggregate commitments of €218bn.

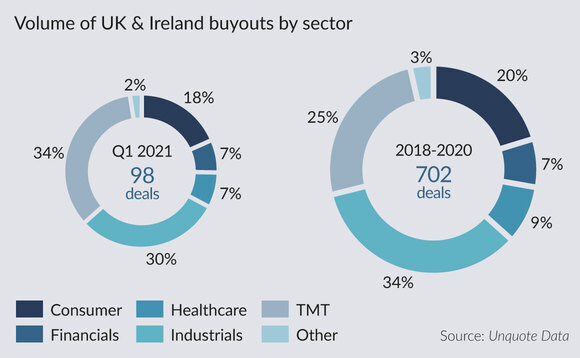

The aggregate value of deals in Q1 this year did not increase commensurably with the volume uptick, though. At an estimated £14.1bn, the figure is £4bn short of Q4's total, and roughly in line with pre-pandemic quarterly totals. This is not surprising when almost all of the dealflow increase compared with Q4 came from small-cap deals valued at less than £50m (53 in Q1 2021 vs 43 in Q4 2020), although it has to be noted that there were seven deals valued between £250-500m in Q1 against just three in Q4 last year.

Activity at the upper end of the market (EVs of £500m and up) was virtually identical quarter-on-quarter, and very much in line with typical pre-pandemic levels, which would go some way towards explaining the fairly standard aggregate enterprise value seen in Q1.

When it comes to deal sourcing, the starkest increase in absolute terms in Q1 came courtesy of family and private vendors – This was unsurprising, given the uptick in dealflow at the smaller end of the market, and lends credence to the view that a mooted CGT rate hike drove a number of entrepreneurs to seek deal completions before March.

Nevertheless, the proportion of UK and Irish deals sourced from such vendors in Q1 (55%) was very much in line with historical standards. If anything, the proportion of secondary buyouts increased (to 31% of all Q1 buyouts, versus 27% when looking at the past five years). This is down to both a solid recovery of such deals in absolute numbers – indicating a renewed appetite to exit portfolio companies after a near-total pause in Q2 and Q3 last year – and to a shortage of deals sourced from corporate vendors. Carve-outs were down to 9% of dealflow in Q1, against 14% over the previous three years.

Correspondingly, the number of PE exits recorded by Unquote rose sharply in both Q4 2020 and Q1 2021, hitting a three-year high of 80 deals in the latter. That said, and unlike what was seen for buyouts, the Q1 total was met or exceeded at several points in 2018, 2017 and 2015. It would seem that, for now at least, UK PE firms remain more firmly in buy mode, even though improved visibility on company financials post-outbreak and strong buy-side appetite should continue fuelling a cash-out on the best performers in portfolios.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds