European GPs making increasingly meaningful personal commitments

According to the latest findings from the Investec Fund Finance GP trends survey, personal commitments made by partners into their funds appear to be increasing in size. Alice Murray reports

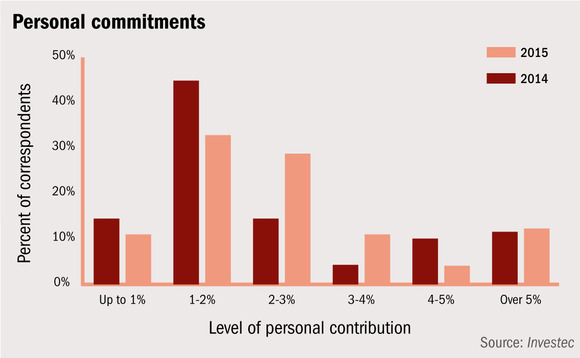

Investec's annual GP trends survey, which canvassed the opinions of 81 UK and European private equity professionals, found that 28.8% of respondents have or will be making a personal contribution of 2-3% of their funds. This is a promising improvement on last year's figures, where only 14.5% of those surveyed were committing this percentage.

Furthermore, we can assume that personal contributions are on the rise, as less survey respondents this year are looking to commit 1-2%. As the graph above shows, 14.5% of respondents made a 1-2% commitment to their own vehicles in 2014 - this has dropped to 11% for 2015. Therefore, the decrease in those committing 1-2% can be explained by the increase in those contributing 2-3%.

Even more encouraging is the rise in respondents looking to commit 3-4%, which has risen from just 4.3% in 2014 to 11% this year. However, the 4-5% personal contribution range has seen a drop from 10.1% of respondents looking to commit this level in 2014 to just 4.1% this year.

For funds aiming for a commitment of more than 5%, there has been a slight increase from 11.6% of respondents in 2014 to 12.3% this year.

Looking at the figures overall, the results are broadly positive. With a decrease witnessed in the sub-1% range (from 14.5% in 2014 to 11% in 2015) as well as in the 1-2% range, combined with increases across the larger ranges, it would appear as though GPs are contributing more meaningful amounts to their own funds.

Confidence abounds

According to Simon Hamilton of Investec's fund finance team, these findings do reveal a trend towards increasing personal contributions: "The big change is from ‘had to' to ‘want to'. As we came out of the crisis, LPs asked for more alignment throughout the whole team - not just from the senior partners. Now we're seeing more people wanting to make these contributions. People are looking at what is going on and they can't see a better opportunity for investing their money."

For Hamilton, this shift highlights growing confidence among private equity teams; individuals want to invest more in their own funds because they are more assured on eventual returns.

However, the challenge now is finding the liquidity to make these contributions. According to Hamilton, 51% of survey respondents do not have liquidity to meet these commitments.

Speaking to several private equity professionals, many individuals seemingly have to make large personal sacrifices to be able to make meaningful commitments, such as forgoing house purchases or re-mortgaging. In other cases, senior partners provide loans for more junior team members.

But what is crucial in this situation is that team members, regardless of their seniority, are making meaningful commitments to their own funds, investing sums that will ensure they go the extra mile to generate out-sized returns.

Over the summer, unquote" explored this issue in depth and highlighted a handful of UK managers that are making significant personal contributions to their funds. The piece found, unsurprisingly, that investing alongside LPs not only helped with fundraising efforts but also had a material impact on deal execution. You can read the article here.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater