Secondary buyouts ebb in H1 2014

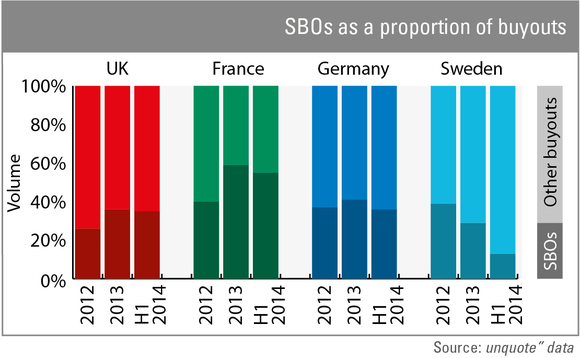

The European secondary buyout (SBO) market cooled in the first half of 2014, accounting for 34% of all buyouts in volume and 48% in aggregate value – down from 40% and 55% respectively in all of 2013. Kenny Wastell reports

Following Europe's record level of SBO activity last year, those seen in the first half of 2014 were more in line with figures from 2011 and 2012, according to unquote" data. Two of Europe's more developed private equity markets, Germany and the UK, mirrored the overall trend in terms of both deal volume and aggregate value.

Having been home to substantial SBO activity last year (41% of all buyouts in volume and 62% in aggregate value), Germany saw these figures fall to 36% and 58% respectively in the first half of 2014 – close to those seen in 2011 and 2012. Meanwhile, the UK, which had proportionally lower SBO activity than usual in 2012, saw these deals account for 35% of volume and 57% of aggregate value throughout H1 2014. Notably, these statistics are almost identical to 2011 and 2013 figures.

In contrast, in the first half of the year the Swedish buyout market has seen deals sourced from other GPs account for just 13% of total volume – down from 39% in 2012 and 29% last year. The drastic drop is reflected in aggregate value also – 7% in 2014, 28% in 2013 and 81% the year before – though 2012's aggregate value was impacted by Cinven and Goldman Sachs Capital Partners' €1.8bn sale of Ahlsell to CVC. While secondary buyouts have ebbed, the proportion of corporate spinouts in Sweden has increased over the past two years, accounting for 40% of private equity buyouts in H1 2014, compared to 14% in 2013 and 10% in 2012.

Helen Steers, partner and head of European primary investment at Pantheon, suggests two factors that may well have influenced these trends. Steers says Swedish corporates themselves are often "very global, with international management", adding that they therefore "lend themselves quite nicely to spinouts". She continues: "Scandinavia probably held up better coming out of the global financial crisis because the banking market was sounder and you didn't have the deep downdraft in GDP that you had in many of the other markets."

Bucking the trend

The rising importance of corporate spinouts seen in Sweden has not been reflected over Europe as a whole, with 17% of GP acquisitions sourced from trade vendors in H1 2014, compared to 18% in 2013 and 15% in 2012. According to Steers: "One of the problems at the moment is many global corporates have quite a lot of cash on their balance sheets. Do they actually need to sell? What would they then do with the cash they'd bring back onto the balance sheet?"

France, in particular, saw incredibly low levels of corporate spinout activity in the first half of this year, with these deals accounting for just 3% of buyouts by private equity houses – down from 12% last year and 14% in 2012. Larger GPs remain reliant on other institutional investors when it comes to sourcing French buyout targets; SBOs accounted for 55% of deal volume in the first half of the year and 54% of aggregate value. According to Steers, much of this can be attributed to the established nature of the private equity industry in France. Here, she argues, large-cap global or pan-European funds often prefer to oversee international expansion of companies that have previously penetrated the French market under the stewardship of local mid-market firms.

Despite the stigma attached to "pass-the-parcel" transactions, LPs can see the logic behind some SBOs, as Steers notes: "Not all SBOs are created equal. Pantheon is a big investor in the small and mid-market buyout segment, so we see a large number of exits to other buyout firms. Where there's a small or mid-market buyout fund, which may be single-country focused, selling onto a larger fund can often be good for the company. Often it needs a different skillset; it needs to be taken to a different level. It's clearly good for the selling fund because they're getting an exit but it can also be an opportunity for the buying fund."

Despite a slight decrease on last year's levels, the European SBO market remains buoyant. While GPs are currently enjoying a fertile atmosphere for exits, sourcing assets at reasonable prices could become increasingly challenging, especially given corporates' apparent reluctance to divest non-core assets. Sourcing businesses from mid-market funds – particularly single-market companies displaying potential for international expansion – might just prove the winning strategy for large-cap players.

All data is sourced from unquote" data, the unquote" proprietary database. To conduct your own searches on pan-European private equity trends, visit unquotedata.com

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater