Articles by Greg Gille

Have your say: UK Watch

With 2013 now behind us and market participants gearing up for a busy 2014, where do you see the UK market heading in the coming months?

Seventure raises €62m towards new life sciences fund

French GP Seventure Partners has held a first close on €62m for Health for Life Capital, a new vehicle with a €120m target.

Inflexion reaps 3.5x on Optionis exit

Inflexion Private Equity has sold employment services company Optionis to MML Capital, realising a 3.5x multiple on its original investment.

Beechbrook backs Simply Biz and N-Sea

Beechbrook Capital has made two new mezzanine investments via its second fund, backing support services business Simply Biz and sub-sea infrastructure services provider N-Sea.

Westbridge Capital reaps 3x on Mobile Computing Systems

Westbridge Capital has sold its stake in software business Mobile Computing Systems (MCS), generating a 3x money multiple.

Neil Woodford to join Oakley Capital

High-profile fund manager Neil Woodford is set to join London-based private equity and asset management business Oakley Capital.

Ardian sells Cegos stake

Ardian has divested its minority stake in French vocational training services business Cegos Group to management and existing shareholder Cegos Association.

Former 17Capital IR manager joins Low Carbon

Louise Ward, Low Carbon

Kester doubles money on Chiltern sale

Kester Capital has sold its stake in clinical services business Chiltern, reaping a 2x money multiple and a 25% IRR.

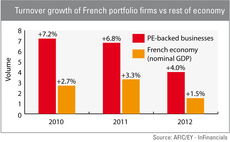

French PE-backed firms outperformed rest of economy in 2012

French private equity-backed companies significantly outperformed their peers in terms of job creation and turnover growth in 2012, according to a new survey by Afic and EY.

Siparex makes 5x on Manuloc exit

Siparex has sold its stake in French logistics business Manuloc to existing backer CM-CIC Capital Finance after more than 10 years as a minority shareholder.

Deal in Focus: Astorg to buy Kerneos for €600m

The background work has finally paid off for Astorg Partners: after looking at a raft of deals in the past 12 months to no avail, the French GP has entered exclusive negotiations to acquire chemicals company Kerneos for €600m.

Astorg to buy Kerneos from Materis for €600m

French GP Astorg Partners has entered exclusive negotiations to acquire chemicals company Kerneos from Wendel-owned Materis for €600m.

Idinvest targets retail investors for new debt fund

French manager Idinvest Partners has started raising a second retail debt vehicle.

Industries & Finances recruits associate

Nicolas Degrassat, Industries & Finances

Rhonda Ryan joins Altius

Rhonda Ryan, Altius Associates

State-backed BPI France pledges not to outbid PE firms

French state investment arm BPI France has pledged it will not look to compete unfairly with local private equity players.

Eurazeo to divest 12% stake in Moncler IPO

Eurazeo, one of the backers of Italian clothing manufacturer Moncler, will see its stake reduced to 19.7% following the company's upcoming IPO.

Weinberg's Alliance Automotive in high-yield refinancing

Alliance Automotive, a French portfolio company of Weinberg Capital Partners (WCP), has issued a €185m private high-yield bond.

Insurers boost allocation to private equity

A Blackrock survey has found that more than half of firms are likely to increase their investment in private equity.

Freshfields private equity star Bown leaves for client CVC

Chris Bown, CVC

Naxicap et al. back Arenadour platform

Naxicap, Arkea Capital and Ouest Croissance have backed the merger of thermal spas Thermes Adour and Thermes des Arènes, creating the Arenadour group.

French mid-cap dealflow stages comeback

French mid-market

Alven injects €3m into Bime

French VC Alven Capital has invested €3m in business intelligence software Bime.