Articles by Greg Gille

EdRip injects €5m into Prozone-Amisco

Edmond de Rothschild Investment Partners (EdRip) has invested €5m in Prozone-Amisco, a French sports data business that is also backed by XAnge Private Equity and Midi Capital.

Axa PE-backed Saur in debt-for-equity swap

Saur, a French water company backed by Axa Private Equity and sovereign wealth fund FSI, will be taken over by its lenders later this month.

Investec provides £110m debt package to Sun's Paragon

Investec Growth & Acquisition Finance has provided a £110m integrated debt facility to refinance the acquisition of Paragon Print & Packaging by Sun European Partners.

UK tech investments: opportunities and pitfalls

The UK's tech space might be once again a target of choice for private equity, but speakers at a Taylor Wessing seminar recently warned investors to tread carefully to make the best of the good times ahead. Greg Gille reports

Citizen Capital et al. inject €5.2m into Camif-Matelsom

French GP Citizen Capital has taken part in a €5.2m round for household products retailer Camif-Matelsom.

CM-CIC Capital Finance buys 12% stake in Courtepaille

CM-CIC Capital Finance has acquired Salvepar's 12% stake in Courtepaille, a French restaurant chain owned by Fondations Capital, for €9m.

Aksia targeting €150m for new fund

Italian mid-cap investor Aksia Group has launched its new fund, Aksia Capital IV, with a €150m target.

Key Capital Partners’ Dwell goes into administration

Furniture retailer chain Dwell has gone into administration, resulting in 23 store closures and 300 jobs shed.

KLS raises €44m towards second Biofund vehicle

Life sciences-focused KLS Partners has held a €44m first close for its sophomore effort, Kurma Biofund II.

Bain to buy Maisons du Monde from Apax, LBO France

Bain Capital has agreed to acquire French home decorations and furniture retail business Maisons du Monde in a secondary buyout understood to be worth around €650m – close to 8x EBITDA.

Index and CM-CIC inject €2.5m into Capitaine Train

French online train booking business Capitaine Train has raised a further €2.5m from its two existing backers, Index Ventures and CM-CIC Capital Privé.

Have your say: 60-second survey

60-second survey

Ekkio Capital backs Compagnie des Vacances

French GP Ekkio Capital, formerly known as Acto Capital, has acquired a 40% stake in online camping sites booking business Compagnie des Vacances.

France's FSN PME fund capacity axed by quarter

France's state-backed venture fund FSN PME will manage €300m overall, down from the €400m mentioned at the vehicle's launch in 2011.

Capzanine holds final closing on €350m hard-cap

French equity and mezzanine provider Capzanine has held a final closing of Capzanine 3 on its €350m hard-cap.

Axa PE buys Trescal in €250m SBO

3i stands to double its money in a little less than three years after agreeing to sell French measurement services specialist Trescal to Axa Private Equity for around €250m.

CIC Mezzanine tops up third fund with extra €15m

French GP CIC Mezzanine is understood to have held a final close for its third fund on €180m, €15m more than the amount announced at the beginning of May.

EQT and GIC opt for Springer Science IPO

EQT and GIC's plans for a potential trade sale of German media publisher Springer Science to BC Partners have definitely been scrapped as the owners firmly focus on a listing.

Tar Heel backs Rockfin in first investment from Fund II

Tar Heel Capital has acquired a 60% stake in Rockfin, a Polish supplier of hydraulic and pressure systems.

Family Office Survey 2013

Keep up to date with the latest trends in the Family Office Investment In Private Equity survey, published in association with Investec.

Nordic Report 2013

Once the darling of European private equity, has the Nordic region lost some of its lustre?

Vision Capital hires Lai as principal

Vision Capital has appointed Bordon Lai as a principal in its New York office.

Carlyle MDs Falézan and Colas to leave next year

Franck Falézan and Benoit Colas, two Carlyle managing directors with a focus on French buyouts, are set to step down in May next year.

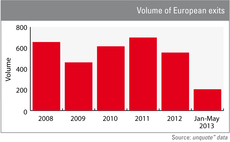

2013 exit activity on course to match quiet 2012

Divestment activity figures so far this year highlight the exit environment remains tough for GPs looking to return cash to investors – although recent weeks have seen positive trends unfolding.