Articles by Greg Gille

Azulis set to hit the road in 2014

French mid-cap GP Azulis Capital is planning to start a new fundraising effort in the first half of 2014. Managing partner Michel Rowan talks to Greg Gille about the upcoming vehicle and the firm’s evolution

CVC acquires Domestic & General from Advent

CVC has agreed to buy insurance business Domestic & General (D&G) from Advent International, alongside management.

CVC set to buy Campbell Europe

CVC Capital Partners has entered exclusive negotiations with Campbell Soup Company to acquire part of its European activities.

Early-stage deals further recover in Q2

Both the volume and overall value of early-stage activity registered a welcome uptick across Europe in the second quarter, according to unquote" data.

Germany shifts into overdrive in Q2

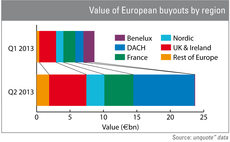

A string of mega-buyouts helped Germany secure the top spot on European buyout value tables in the second quarter of this year.

Pamplona to leverage OGF purchase with €635m debt package

The recently announced buyout of French funeral services operator OGF by Pamplona will be financed by a €635m debt package, according to media reports.

Lion's Picard issues €480m floating rate note

Picard Surgelés, a French portfolio company of Lion Capital, has issued a €480m floating rate note to refinance part of its debt.

Investcorp buys snack manufacturer Tyrrells for £100m

Investcorp has acquired Tyrrells Potato Crisps, a UK-based manufacturer of crisps and snacks, from Langholm Capital for £100m.

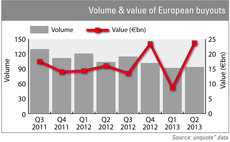

Q2: overall buyout value soars by 174%

The European buyout market recovered spectacularly in value terms in Q2 on the back of a string of mega-deals, but the overall volume of activity remains lacklustre.

SJ Berwin-King & Wood merger gets green light, creates $1bn global giant

SJ Berwin has sealed its merger with Asia-Pacific giant King & Wood Mallesons (KWM), creating a $1bn (£657m) firm, with the SJ Berwin name set to disappear after a transitional period.

Pamplona set to buy OGF from Astorg

Pamplona Capital Management is set to acquire French funeral services provider OGF from Astorg Partners, a deal reportedly valued at around €900m.

Bridgepoint asks for extension on 2008 fund

Bridgepoint has asked investors in the €4.8bn Bridgepoint Europe IV (BE IV) vehicle for a 12-month extension of the fund’s investment period, which was due to end in November this year.

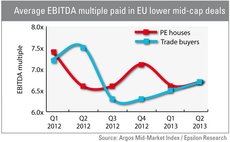

Mid-cap valuations remain stable as dealflow stagnates

Mid-cap valuations

French VCs in €23.5m round for Withings

State-backed investor BPI France, Idinvest Partners, 360 Capital Partners and existing backer Ventech have invested €23.5m in French smart devices business Withings.

UI Gestion injects €15m into GBNA

French GP UI Gestion has provided private healthcare group GBNA with €15m of growth capital funding.

Axa PE given green light for Club Med takeover

French regulatory body AMF has authorised Axa Private Equity and Fosun's joint bid for listed French holiday resorts group Club Méditerranée.

Elior sale back on track, Axa PE in lead

Axa Private Equity and Caisse de Dépôt et Placement du Québec (CDPQ) have made a revised joint bid for Charterhouse's French catering business Elior, according to reports in the local press.

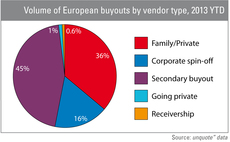

"Pass-the-parcel" deals creep up in H1

Secondary buyouts have accounted for 45% of the overall number of buyouts in the first half of 2013, the highest proportion witnessed since the onset of the financial crisis, according to unquote" data.

Foresight backs Aerospace Tooling BIMBO

Foresight has invested £3.5m in the buy-in management buyout (BIMBO) of Scottish precision engineering company Aerospace Tooling.

Cinven to relinquish control of Frans Bonhomme

Frans Bonhomme, a French plastic pipes specialist owned by Cinven, is reportedly about to be taken over by its creditors.

Qualium et al. buy Invicta in MBI

Qualium Investissement has acquired a majority stake in the management buy-in of French wood-based heating devices manufacturer Invicta.

BDC's Mezzo di Pasta enters safeguard procedure

Mezzo di Pasta, a French portfolio company of Bridgepoint Development Capital, has gone into "redressement judiciaire", a court-overseen safeguard procedure akin to the UK's receivership.

French PE still outperforms rest of continental Europe

French private equity funds have returned 8.6% since inception, according to the latest performance figures published by local trade body AFIC.

Dwell bought back by founder

Dwell, a UK-based furniture chain backed by Key Capital Partners that went into administration at the end of June, has been bought back by founder Aamir Ahmad.