Articles by Alice Tchernookova

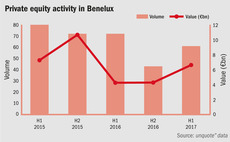

Benelux activity picks up in first half of 2017

Following a slow H2 in 2016, dealflow in the Benelux region is on the up with Belgium in particular seeing increasing activity

François Fillon joins Tikehau Capital as partner

Fillon ran as candidate for France's Les Republicains party in the country's 2017 presidential election

AlpInvest hires Bagijn as primaries business head

New managing director is joining from her previous role at Axa Investment Managers

Mentha mulling Optimum sale

Mentha Capital took a majority stake in Optimum in 2014, investing from Mentha Capital Fund IV

Mentha Capital exits Venko Groep

Mentha sells the Dutch business to Clayton Dubilier & Rice portfolio company BrandSafway

Maven Capital appoints Hopwood as investment director

Craig Hopwood joins the GP's northern team from HSBC, where he was a director

Endless backs Sewtec Automation MBO

Endless is currently investing from Endless Fund IV, which closed on £525m in 2014

TGFS, HTGF in seed round for FlyNex

TGFS and HTGF provide seed and early-stage funding to German tech-focused startups

Astorg, Montagu partially exit Sebia to CDPQ

Astorg and Montagu acquired the healthcare company from Cinven in 2014

Blackstone to acquire JOA from Alchemy

Alchemy had taken a majority stake in JOA in 2014 through a quarternary buyout

LFPI invests in Eductive

BPI France and BNP Paribas Développement join in as minority co-investors

UI Gestion backs Sofilab management buy-back

UI Gestion has backed Sofilab since 2003 through its Irpac Développement vehicle

BPI, Idia and Sofipaca invest in Keep Cool

Keep Cool's founder will retain a majority stake in the company following the transaction

Apax/EPF merger highlights consolidation trend in French GP landscape

Apax's acquisition of EPF Partners is the latest in a number of consolidation plays within the French market

NextStage to take majority stake in Dream Yacht Charter

NextStage is currently investing from €69m growth and buyout fund FCPR Nextstage PME Championnes II

Equistone to acquire Bruneau

GP will invest through Equistone Partners Europe V, closed on its hard-cap of €2bn in 2015

MBO Partenaires acquires Cellier, Orthofiga

MBO closed its fourth buyout fund, MBO Partenaires 4, on its €250m hard-cap last year

LBO France acquires Serapid

LBO France draws equity from its small-cap buyout vehicle Hexagone III, closed on €154m in 2010

Pragma Capital exits Groupe Brunet

Pragma Capital acquired Azulis Capital's majority stake in the company in 2011

Deal in Focus: Ekkio Capital exits Amatsigroup

Under the GP's seven-year tenure, the pharmaceuticals business bolted on numerous competitors and acquired new laboratories

Carvest and Loire-Centre Capital back ATER MBO with €2m

Siparex and Sodero Gestion, which previously held a 37.5% stake, are fully exiting the company

Omnes carves out three Geoxia subsidiaries

LBO France became the majority shareholder of Geoxia in 2009 as part of a restructuring

BlackFin holds €100m first close for BlackFin Tech Fund 1

BlackFin is targeting €150m for the fund's final close by the end of the year

IK acquires Bretèche Industrie from Equistone

IK is investing through the IK VIII Fund, closed on its €1.85bn hard-cap last year